Abstract

We examine the impact of climate risks on the nexus of clean energy and technology stocks using a time-varying correlation model. We find that physical and transition climate risks are positively associated with the long-term correlation between clean energy and technology stock indices, whereas the effect of transition risk is more robust to different sample periods and alternative stock indices. On the contrary, the short-term correlation tends to decrease after shocks to physical risk, since clean energy stocks react more strongly to physical risk shocks than technology stocks.

Similar content being viewed by others

1 Introduction

Since climate change provably affects financial assets, investors are advised to properly assess their portfolio exposure to climate risk in order to take effective hedging measures (Giglio et al., 2021). Not only the energy sector (van Benthem et al., 2022) but also technology companies can be particularly exposed to climate change due to the growing demand for alternative energy sources, which often require technological innovations. Hence, the stocks of clean energy firms are highly interrelated with technologies stocks and both significantly affect each other’s returns [e.g., Henriques and Sadorsky (2008)].

We show that the interrelation between clean energy and technology stocks is significantly associated with both physical and transition climate risk, which we measure over a sample period from January 2005 to June 2022 via the news-based climate risk indices recently proposed by Bua et al. (2022). Modeling the dynamic conditional correlation between representative U.S. stock indices of both sectors with a time-varying long-term correlation component suggests that higher climate risks contribute to an increased long-term correlation. In contrast to physical risk, the effect of transition risk is robust to different samples, including global and European equity indices. Regressing the short-term correlation between clean energy and technology stocks on climate risks—while controlling for oil prices, several stock market variables, economic policy uncertainty, and business cycle variations—reveals that physical climate risks are negatively associated with the short-term correlation. On a return level, clean energy stocks react more strongly to physical risk innovations than technology stocks, leading to a temporary decrease in correlation. Given the interdependence of both industries and the ensuing bidirectional return and risk spillovers, our results can help investors understand the main determinants of the relationship between clean energy and technology stocks.

In recent years, the growing global focus on climate change has fueled the growth of green and climate finance as a new strand of literature (Breitenstein et al., 2021; Giglio et al., 2021). The role of climate-related risks in financial markets is attracting considerable attention, following the increasingly frequent actions taken by governments to mitigate global warming (Breitenstein et al., 2021). A new stream in the literature on climate finance aims to answer research questions in light of the emerging climate crisis, providing evidence that climate risks affect economic growth [e.g., Stern and Stern (2007)], asset prices [e.g., Painter (2020), Baldauf et al. (2020), Bolton and Kacperczyk (2021), Bua et al. (2022)], firms’ profitability [e.g., Addoum et al. (2020)], assets’ hedging and safe-haven abilities [e.g., Cepni et al. (2022)], firms’ investment decisions [e.g., Engle et al. (2020)], and other economic variables. Climate risks have the potential to redefine the relationships of various assets. For example, Flori et al. (2021) study how climate variables influence the co-movement of commodity prices and, thus, impact financial stability.

The relation of clean energy and technology stocks might be particularly influenced by climate risks. In line with empirical findings, the equilibrium model of Barnett (2023) suggests that climate change increases the amount of clean (i.e., low-carbon) input used in production. Given the immense energy consumption in production and the carbon intensity of conventional energy sources, this is of particular relevance for the clean energy sector and related technology firms. With increasing climate risks, investors could shift their capital into clean energy stocks, as they are expected to benefit from the transition to green energy. Similarly, technology companies may attract investors in times of high climate risk, given their importance for the energy transition and their low carbon emissions. The transition to cleaner energy production and, in general, towards a less carbon-intensive economy requires technological advances in several areas, such as innovation in power generation, smart grid development, carbon removal solutions, energy storage, and battery technologies (Popp, 2011). Hence, the performance of alternative energy companies largely depends on the success or failure of these technologies, providing a possible explanation for the strong co-movement of clean energy and technology stock prices. Existing studies argue that investors’ perceptions of clean energy and technology stocks are similar (Henriques and Sadorsky, 2008; Kumar et al., 2012; Sadorsky, 2012). With increasing climate risks, clean energy and technology markets could grow even closer together in terms of collaboration, joint revenue streams, shared input resources, human capital, and risk factors. If risks arising from climate change are relevant to the relationship of clean energy and technology companies, investors should carefully consider this for investment decisions and portfolio selection.

Our study contributes to two research streams. First, we add to the general literature on climate finance and show that climate risk shocks may not only affect equity returns [e.g., Giglio et al. (2021)] and volatility (Meinerding et al., 2023) but can also drive the return connectedness of different industries. This can have important implications for portfolio diversification and climate risk hedging. We further underline the importance of disentangling physical and transition climate risk, as we find differing effects on the connection of clean energy and technology stocks, depending on the time horizon. Second, we introduce a novel discussion for the literature on the interrelation between the prices for clean energy stocks and technology stocks by explicitly accounting for the role of climate change risks. Most studies investigating the nexus of clean energy and technology stocks focus on the role of oil prices and other fossil fuels, although clean energy stocks might have more in common with technology companies than with fossil-fuel-based energy companies (Zhang and Du, 2017). However, the literature lacks evidence on whether climate-related risks affect the relationship between these two sectors. The identified effects of changes in oil price on clean energy stocks may be mainly due to climate risks which might be implicitly reflected by the price of oil. Hence, we examine whether climate risks are expected to further tighten the stocks’ interrelation of both markets. Consistent with existing studies, the oil price appears to only weakly affect the correlation of the indices of clean energy and technology stocks. Instead, we are the first to show that—relative to oil prices—climate risk is of first-order importance for the stock return nexus of both sectors.

The remainder of this paper is organized as follows. Section 2 provides a review of the literature on the link between technology and clean energy stocks. Section 3 describes the climate risk indicators, the technology and clean energy stock indices, as well as the correlation measures. Section 4 discusses the main results on the association of physical and transition climate risks with the long- and short-term correlation between clean energy and technology stock indices. Section 5 concludes the paper.

2 Related studies on the technology and clean energy nexus

Previous studies have analyzed the interconnection of clean energy and technology stocks using various methodologies and samples. Among others, Sadorsky (2012) documents the strong positive correlation between stock indices of both industries. The positive correlation implies a bidirectional transfer of shocks to returns and volatility, as numerous studies suggest. Henriques and Sadorsky (2008) find that clean energy stock prices are positively and significantly affected by price shocks to technology stocks and vice versa. This finding is confirmed by Kumar et al. (2012), Zhang and Du (2017), Kocaarslan and Soytas (2019), and Maghyereh et al. (2019), among others. Also, volatility transmits positively between the two markets (Sadorsky, 2012; Maghyereh et al., 2019). These results generally hold for multiple time horizons. Shocks to one market can have a significant and persistent impact on the other market over several months [e.g., Henriques and Sadorsky (2008), Kumar et al. (2012), Zhang and Du (2017)]. In contrast, some studies obtain differing results regarding the time horizon. Unlike their short-term results, Kocaarslan and Soytas (2019) find that negative technology stock returns have a more pronounced long-term impact on clean energy stocks than positive returns. Although the authors observe the same asymmetry in the short-term effects of clean energy stock returns on technology stocks, this finding reverses in the long run, where positive returns in clean energy stocks exert a stronger impact on technology stocks than negative returns. Bondia et al. (2016) only documents short-term Granger causality from technology to clean energy stocks but cannot confirm this result for longer horizons. Likewise, the results of Maghyereh et al. (2019) depend on the time scale. This underscores the importance of disentangling our correlation analysis into a short-term and long-term setting.

Except for Sadorsky (2012) and Maghyereh et al. (2019), existing studies do not explicitly focus on modeling the correlation between clean energy and technology stocks. Most studies analyze return and risk spillovers between both industries, often in relation to oil prices. However, the literature lacks evidence on the drivers of this strong interconnection. One could argue that the increase in the costs of conventional energy sources due to the rising prices of fossil fuels stimulates investment in technology-based clean energy firms (Henriques and Sadorsky, 2008; Kumar et al., 2012). If so, a stronger association of clean energy and technology stocks might be motivated by oil price movements (Saeed et al., 2021). Although some studies empirically confirm a significant relation between oil prices and stock prices of clean energy companies [e.g., Henriques and Sadorsky (2008), Kumar et al. (2012), Kocaarslan and Soytas (2019), Maghyereh et al. (2019)), most published research finds that compared to the effect of technology stocks, fossil fuel prices only play a minor role for the performance of clean energy stocks. Compared to conventional energy companies or oil prices, technology stocks appear to have a much closer connection to clean energy stocks in terms of correlation (Sadorsky, 2012; Zhang and Du, 2017; Maghyereh et al., 2019), the impact of changes and shocks on previous prices (Henriques and Sadorsky, 2008; Sun et al., 2019), and volatility spillovers (Qu et al., 2021). Lyocsa and Todorova (2023) find that the variation in technology prices is more informative for subsequent volatility in clean energy stocks than oil price variations. Also, Ferrer et al. (2018) cannot identify oil prices as a crucial determinant of clean energy stock returns in the short or long run. Inchauspe et al. (2015) and Reboredo et al. (2017) find a greater importance of oil prices for clean energy stocks in the years of the global financial crisis. However, it is likely that this result is subject to the so-called “financialization” of commodity markets, during which the overall co-movement of commodity and stock markets increased substantially [e.g., Büyükşahin and Robe (2014), Adams and Glück (2015), Dudda et al. (2022)]. Recent findings suggest that oil and other commodities have already decoupled from stock markets in recent years [e.g., Aromi and Clements (2019), Adams et al. (2020)].

In general, the results from the literature indicate that technology stock prices are more closely related to clean energy stocks than oil prices, suggesting that oil prices also contribute little to the relationship between clean energy and technology stocks. Fahmy (2022) finds that the prices of technology stocks superseded oil as one of the main determinants of clean energy stock prices after the Paris agreement. According to Fahmy (2022), this suggests that climate-related events raise the climate risk awareness of investors and encourage a shift in preferences toward green investments. Surprisingly, the literature did not pay attention to the role of climate-related risk with respect to the nexus of clean energy and technology stocks. Like Bondia et al. (2016), we argue that increasing oil prices are not the primary growth driver for the alternative energy sector and that the transition to cleaner energy is driven in large part by environmental concerns. Therefore, we claim that not changing oil prices but climate risk should mainly contribute to the association of technology and clean energy stocks. Our study adds to the results of Fahmy (2022) by explicitly focusing on the influence of climate-related risks for the time-varying relationship of both sectors. Thereby, we also expand on the results of Sadorsky (2012) and Maghyereh et al. (2019), who compare the dynamic conditional correlations of clean energy and technology stock indices to their correlation with the returns of crude oil futures contracts.

3 Data and methodology

3.1 Climate risk measures

The literature on climate finance emphasizes the need to dissociate physical and transition risks due to their potentially disparate effects on financial markets [see, e.g., Engle et al. (2020), Faccini et al. (2023), Giglio et al. (2021), Bua et al. (2022), Cepni et al. (2022)]. According to the Task Force on Climate-related Financial Disclosures, created by the Financial Stability Board, physical climate risk arises from acute extreme weather events, e.g. floods and heat waves, or chronic changes in climate patterns, such as rising sea levels through a permanent increase in global temperature. On the other hand, transition risk emanates from the shift towards a low-carbon economy, typically induced by regulatory, technological, and market changes, or changes in public preferences (TCFD, 2017; Breitenstein et al., 2022). To account for potential effects of both types of climate risks on the correlation of clean energy and technology stock markets, we use daily data of physical (PRI) and transition (TRI) climate risk indices from January 03, 2005, through June 30, 2022.Footnote 1 Both indicators were developed by Bua et al. (2022) to gauge the magnitude of shocks to the respective type of climate risk. Consistent with Engle et al. (2020), the risk indices are based on a textual analysis approach of articles published by Reuters News, a widely used news source by financial investors to update investment decisions. Measures are constructed based on the assumption that a growing physical or transition risk increases the density of news that covers associated topics. Starting from a list of scientific texts on climate change published by government authorities and other institutions, the authors first compile content-specific physical and transition risk documents. They compare these documents with the news corpus using the cosine similarity technique, as in Engle et al. (2020), to generate a series of physical and transition concerns. The obtained series represent the portion of the news coverage dedicated to each type of climate risk. To capture innovations in climate risk, the authors fit an autoregressive model of order one to each of the two concern series and finally build the PRI and TRI from its residuals.

PRI and TRI aim to capture the distinct characteristics of each type of climate risk, unlike other studies that mainly capture subdimensions of physical and transition risk [e.g., Ardia et al. (2022), Faccini et al. (2023), Pankratz et al. (2023)] or consider climate change as a unique risk factor (Engle et al., 2020; Gavriilidis, 2021). Furthermore, PRI and TRI measure climate risks at a daily frequency, while alternative climate risk indicators are calculated monthly. We compare our results for PRI and TRI against the Wall Street Journal (WSJ) and the Crimson Hexagon negative sentiment (CHNEG) climate change news indices used in Engle et al. (2020), as well as the climate policy uncertainty (CPU) index of Gavriilidis (2021).

3.2 Technology and clean energy returns

Over the sample period set by the availability of climate risk data, we obtain daily closing prices from Refinitiv Datastream for the NYSE Arca Technology 100 (PSE) and the WilderHill Clean Energy (ECO) indices as representative market indices for U.S.-listed technology and clean energy stocks.Footnote 2 The PSE is a price-weighted index that reflects the stock performance of 100 companies that are associated with innovative technologies in different industries. ECO tracks the performance of the stocks of clean energy companies that are expected to benefit from the decarbonization of the economy by gradually replacing fossil fuels and nuclear energy with cleaner energy solutions.Footnote 3

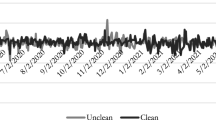

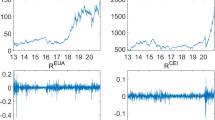

Figure 1 shows the development of the stock and climate risk indices during the sample period. Table 1 provides summary statistics. The minimum and maximum daily log returns, the standard deviation, and kurtosis indicate that ECO is more volatile than PSE and that extreme price movements are more vigorous and occur more frequently, which is also visible in Fig. 1. Ljung-Box test statistics detect autocorrelation in the returns and squared returns. Consistently, ARCH effects are present in both return series according to the Lagrange-Multiplier test of Engle (1982). Thus, it is reasonable to filter stock returns with a GARCH model before estimating dynamic conditional correlations. Daily PRI and TRI are strongly skewed to the right, implying that climate risk can experience unexpected sharp increases on a daily level. Monthly PRI and TRI appear less erratic and move within a narrower range with much lower extreme values since standard deviation, skewness, and kurtosis are substantially reduced by monthly averaging, which is also apparent in Fig. 1. Although the daily indices seem to carry higher noise than their monthly averages, they might be better at capturing the events that lead to extreme surges of climate risk. Shocks and squared shocks to physical and transition climate risk exhibit significant autocorrelation. Only for monthly averages, the Lagrange multiplier test cannot identify ARCH effects. The Jarque–Bera test reveals that only the monthly PRI is normally distributed among all variables. The ADF and KPSS tests indicate that the daily log returns of the stock indices are stationary, while the KPSS test detects a unit root in the monthly averages of PRI and TRI. The test results on the stationarity of the daily PRI and TRI time series are contradictory.

3.3 Correlation measures

Given the long-term characteristics [e.g., Bansal et al. (2016)] on the one hand and also the more recent short-term financial relevance of climate risks on the other hand [e.g., Bua et al. (2022)], we assess the effect of physical and transition risks on both the long-term correlation between the returns of clean energy and technology stock indices and their daily correlation dynamics. We estimate daily dynamic conditional correlations using the standard DCC-GARCH model of Engle (2002). To model long-term correlations, we follow Colacito et al. (2011) and Conrad et al. (2014), who introduce a time-varying long-term correlation component to the original DCC-GARCH model using mixed data sampling (MIDAS) regressions.

Following Engle (2002) and Colacito et al. (2011), we consider a vector of daily returns \(r_t=(r_{T,t},r_{E,t})'\) of technology (T) and clean energy (E) stocks. We define \(\mathbb E\left[ r_t\mid \Omega _{t-1} \right] =\mu =(\mu _T,\mu _E)'\) and the residuals \(\epsilon _t=r_t-\mu =(\epsilon _{T,t},\epsilon _{E,t})'\), where \(\Omega _{t-1}\) is a sigma algebra that contains the information set available up to \(t-1\). The conditional covariance of the process is then defined as \( H_t=\mathbb V\left[ \epsilon _t \mid \Omega _{t-1}\right] =D_t R_t D_t\) with \(R_t=\mathbb E\left[ \eta _t \eta _t'\right] \) and \( D_t = {{\,\textrm{diag}\,}}\left( \sqrt{h_{T,t}}, \sqrt{h_{E,t}} \right) \). Then, the standardized residuals are \(\eta _t=D_t^{-1} \epsilon _t=(\eta _{T,t},\eta _{E,t})'\) with \(\eta _t \sim N(0,I_2)\). We define the univariate conditional variance processes \(h_{T,t}\) and \(h_{E,t}\) by the GJR-GARCH(1, 1) model (Glosten et al., 1993) using a Student-t distribution for i.i.d. errors. The dynamics of the DCC are then incorporated into a quasi-correlation matrix \(Q_t\) with the elements \(q_{ij,t}\) for \(i,j\in [T,E]\):

Following Colacito et al. (2011) and Conrad et al. (2014), we allow monthly time variation in the long-term correlation between technology and clean energy firms described by \(\bar{\rho }_{ij,\tau }\).Footnote 4 We assume that the monthly-moving long-term correlation component is driven by climate risk. To ensure \(\bar{\rho }_{ij,\tau } \in [-1,1]\), we apply the Fisher-z transformation and define:

with

where \(z_{ij,\tau }\) is driven by an exogenous variable \(X_\tau \) available at monthly frequency. We choose the beta polynomial \(\varphi _k(\omega )\) as the MIDAS weighting scheme. The beta function assigns weights to each of the past K monthly observations of the long-term correlation driver \(X_\tau \). Depending on \(\omega \), it can produce various weighting schemes such as equal weights, slowly or rapidly decreasing weights, hump-shaped weights, and other forms (Ghysels et al., 2007). In our case, the exogenous variable \(X_\tau \) is given by monthly averages of TRI or PRI. Therefore, the parameter \(\theta \) represents the overall impact of the weighted lagged monthly observations of the climate risk indicators on the long-term correlation between the energy and technology stock indices. Like Colacito et al. (2011), we also consider lagged monthly realized correlations (RC) as explanatory variables for the long-term correlation.

Finally, the conditional correlation matrix is \(R_t={{\,\textrm{diag}\,}}(Q_t)^{-\frac{1}{2}} Q_t {{\,\textrm{diag}\,}}(Q_t)^{-\frac{1}{2}}\) with its elements \(\rho _{ij,t}\). We estimate the parameters using a two-stage Quasi Maximum-Likelihood estimation. In the first step, we estimate the univariate variance processes with GJR-GARCH followed by the synchronization of standardized residuals and the parameter estimation of the DCC-MIDAS model.

To test the robustness of our results regarding the choice of the correlation measure, we further use simple rolling window correlations (RWC) as a parameter-free alternative to estimate daily time-varying correlations.

4 Results

4.1 The impact of climate risk on long-term correlation

The estimated DCC parameters are presented in Table 2. Figure 2 shows the estimated daily correlations together with the monthly-moving long-term correlation component. The correlation process is rather persistent, with a high value for \(\beta \) and a value close to one for the sum of \(\alpha \) and \(\beta \) for all DCC model variants. The daily correlation ranges between 0.1124 and 0.9274. The standard DCC indicates that the average long-term correlation is 0.7044, whereas the long-term correlation component modeled with PRI (TRI) fluctuates between 0.4623 and 0.8316 (0.5087 and 0.8664). The estimated long-term correlation driven by PRI and TRI is close to 0.8 at the beginning of our sample and decreases afterward to its lowest level of around 0.5 between the middle of 2016 and the beginning of 2017. Since then, both modeled long-term correlation series have shown an upward trend, increasing again to a level of 0.7 by the end of our sample in June 2022. Thus, similar to the findings of Fahmy (2022), we observe an increased correlation in the period after the Paris Agreement entered into force on November 4, 2017. According to the parameter estimates for \(\theta \), both types of climate risk are positively associated with the long-term correlation between technology and clean energy firms at the 5 and 10% levels, respectively.Footnote 5 An increase in physical or transition climate risk, hence, leads to a higher correlation between US technology and clean energy stocks in the long term.Footnote 6 In contrast, we find that realized correlations do not drive the long-term correlation.

Estimated dynamic conditional correlation between daily log-returns of the NYSE Arca Technology 100 (PSE) and the WilderHill Clean Energy (ECO) stock indices with climate risk as a driver of the monthly-moving long-term correlation component. The MIDAS-term of the DCC model includes \(K=36\) lags of monthly observations of either physical (PRI) or transition risk (TRI)

For the more general climate risk index of Engle et al. (2020) (WSJ), which does not distinguish between physical and transition risk, we find a positive but statistically insignificant effect on the long-term correlation of energy and technology stocks using the available index data until June 2017. Using their measure, which only covers negative news about climate change (CHNEG), available from June 2008 to May 2018, yields a significant and positive association with the correlation. During both periods over which data on the indices from Engle et al. (2020) is available, only TRI shows a statistically significant link to the correlation of technology and clean energy stocks, indicating the importance of disentangling climate risk into its physical and transition risk components. Similarly, we obtain a positive but insignificant parameter estimate for the effect of the CPU index constructed in Gavriilidis (2021), which aims to represent the uncertainty of climate policy rather than the risk of climate change.Footnote 7

Since PRI and TRI are created from news with a European focus, we also estimate the correlation between ECO and European technology stocks (EURO STOXX Technology), the PSE and global clean energy stock markets (S &P Global Clean Energy), and between European technology stocks and the global clean energy index. Consistent with the results of the U.S. indices presented in Table 2, we find that the effect of TRI on long-term correlation for all pairs of energy and technology indices remains positive and significant using lags of 24 to 60 months for the MIDAS term. The effect of PRI is less robust, as we do not find significant links of PRI to the correlation among all index pairs and lags. More specifically, we can determine PRI as a significant driver of the long-term correlation between ECO and European technology stocks only when using a lag length of \(K=48\) months but not for a lag length of 24, 36, or 60 months. We obtain the same finding for the correlation of PSE with global clean energy stocks. The positive effect of PRI on the long-term correlation of European technology stocks and global clean energy stocks remains significant, except for 24 lags. In all model variants, the influence of TRI and PRI on correlation is estimated to be strongly positive, though the parameter estimates are smaller than for the correlation between ECO and PSE. This is due to the average long-term correlation between European technology and global clean energy stocks and their correlation to the U.S. indices ranging between 0.4159 and 0.5166 according to the standard DCC model and, thereby, being lower than the correlation between ECO and PSE.Footnote 8

In sum, our findings indicate that the long-term correlation component is primarily driven by transition risk. This is an intuitive finding. In the long term, changing consumer preferences toward climate-friendly energy solutions, regulatory changes, or, most importantly, related technological advances should play a more important role than physical climate risk events in driving the two sectors closer together. The literature on climate finance already documents that transition risks, such as uncertainty about environmental policy, are priced in equity markets (Giglio et al., 2021; Hsu et al., 2023). The results of Engle et al. (2020) suggest a negative relationship between firms’ exposure to regulatory climate risk and their stock returns. This might be particularly true for clean energy and related technology companies with negative exposure to regulatory climate risk, meaning that both should benefit from stricter regulations. The results of Faccini et al. (2023) indicate that stock prices are mainly affected by transition risks, especially those related to climate policy, while physical risks appear less important. This conclusion is, however, not confirmed by Bua et al. (2022), who use more comprehensive measures of physical and transition risk. Their study indicates the existence of both a transition and a physical risk premium in recent years. Ardia et al. (2022) finds that green firms’ stock prices appear to rise in response to shocks from transition and physical climate risk. Similarly, our results suggest that, next to transition risks, also physical climate risks might positively affect the long-term interrelation between clean energy and technology stocks (which can be generally considered as “green”), especially in U.S. markets. This could be due to investors adjusting their view on transition risks, e.g., in anticipation of regulatory changes, based on an increased accumulation of acute extreme weather events (Alekseev et al., 2022). For example, Choi et al. (2020) show that the carbon intensity of firms negatively relates to their stock performance during periods with unusually warm temperatures where investors might be particularly aware of global warming. We add to the climate finance literature by showing that the long-term return connectedness of stocks with a negative climate risk exposure can also tighten with rising physical and transition climate risk. In the next section, we focus on the dynamics of short-term correlation and whether daily variations in climate risk are helpful to explain them.

4.2 Climate risk and daily correlation dynamics

To assess the impact of climate risks on the daily correlation dynamics of clean energy and technology stocks, we take the daily conditional correlation from either the standard DCC model without a moving long-term component or a simple rolling window correlation estimated over 22 lags (RWC) and regress it on lagged daily values of TRI and PRI.Footnote 9 Our regression model with N covariates reads as follows:

where L denotes the lag operator: \(L^kx_t = x_{t-k}\) and \(b_j(L_k) = \left( b_{j1}L^1 + b_{j2}L^2 + \cdots + b_{jk}L^k \right) \), \(j=1,...,N\). In addition to lagged correlation, PRI and TRI, we include additional controls, \(X_{jt}\), \(j=4,...,N\), which potentially affect daily correlation. For robustness, we replace the correlation measure \(DCC_t\) with \(RWC_t\) estimated from daily returns between trading day \(t-22\) and \(t-1\).

We test the association of PRI and TRI on the correlation over the following three trading days, i.e., we set \(k=3\). Since the correlation at time t is estimated based on returns up to \(t-1\), the model also captures the contemporaneous effect of climate risk shocks on stock returns. We account for the discussion in the literature on the effects of oil prices on clean energy stocks by including daily WTI crude oil spot returns as a control variable.Footnote 10 Previous studies further document that clean energy stock prices are affected by market volatility and policy uncertainty [e.g., Ferrer et al. (2018), Lundgren et al. (2018), Uddin et al. (2019), Yahya et al. (2021)]. We use the Cboe Volatility Index (VIX) and the change in Economic Policy Uncertainty (EPU) to control for these effects. Based on option prices, the VIX captures the 30-day implied volatility in the S &P 500 index and is recognized to signal the level of fear or stress in the stock market. EPU is measured by a news-based index of Baker et al. (2016) and is already adopted by various studies [e.g., Pástor and Veronesi (2013), Brogaard and Detzel (2015)]. Because clean energy and technology stocks as well as their connectedness can be sensitive to business cycle fluctuations [see Kumar et al. (2012), Ferrer et al. (2018), Kocaarslan and Soytas (2019), Fahmy (2022)], we also include the Aruoba-Diebold-Scotti Business Conditions Index [ADS, Aruoba et al. (2009)]. Furthermore, we control for autoregression by lagged correlation, returns of the S &P 500 index, changes in the 3-month U.S. Treasury Bill rate, as well as for calendar effects for January and the day of the week. All time series are retrieved from Refinitiv Datastream. We use HAC standard errors with five lags to adjust for possible heteroskedasticity. The results for the U.S. stock indices are provided in Table 3.

Contrary to the long-term dynamics of the correlation between technology and clean energy companies, the daily correlation is influenced by physical climate risk rather than transition risk. The relation of PRI to the short-term correlation remains statistically significant after controlling for financial and economic indicators. In our sample, physical climate risks are negatively associated with the correlation over the following trading days. A one standard deviation shock to PRI decreases the next day’s correlation by \((-0.0610 \times 0.0211) = -0.0013\) points as estimated by the DCC.Footnote 11 Thus, periods of physical risk tend to decrease the short-term correlation.Footnote 12 Based on adding quantile dummies and interaction terms for PRI and TRI to our regression model, we cannot establish significant reactions of the correlation to extreme climate risk shocks.

We do not find a significant link between oil price changes and the short-term DCC of clean energy and technology stocks and only a few weakly significant effects on RWC.Footnote 13 This observation fits well with the results obtained by previous studies, which indicate that oil prices are of subordinate importance for the performance of both clean energy and technology stocks [e.g., Henriques and Sadorsky (2008), Sadorsky (2012), Maghyereh et al. (2019), Fahmy (2022)]. Our results add to these findings, as they suggest that oil prices are also not the main determinant of the close relationship between the stock returns of both sectors. Instead, this relationship appears to be significantly driven by climate risks.

4.3 Different climate risk effects on the returns of technology and clean energy stocks

The negative association of PRI with the short-term correlation does not necessarily mean that the returns of clean energy and technology stocks move in opposite directions after physical climate risk shocks. We expect that the negative effect on correlation is induced by a relatively stronger short-term reaction of clean energy stock returns to physical risk shocks since expected cash flows of clean energy firms are directly associated with climate risks. With regard to climate risks, technology firms have more diversified cash flows, which are only partially generated by selling alternative energy technologies. Therefore, their cash flow expectations should have a relatively smaller negative exposure to climate risks, meaning that their stock prices would be less affected by daily fluctuations of PRI. We test our hypothesis by regressing the daily returns of clean energy and technology stocks on PRI using lagged stock returns, TRI, WTI returns, S &P 500 returns, the VIX, and changes in EPU, ADS, and the 3-month U.S. Treasury Bill rate, as well as a January dummy and day-of-the-week effects. We include one contemporaneous and two lags of the climate risk measures in the return regression to capture the immediate reaction of stock prices to the relevant news. This is consistent with our regression model from (4), which also accounts for the contemporaneous nexus between the climate risk indices and stock returns. Specifically, we estimate the following regression:

where \(r_{i,t}\) denotes the returns of PSE or ECO, and \(k=2\).

The estimated coefficients of interest are presented in Table 4. Although we do not find statistically significant effects, the coefficients for the contemporaneous effect of PRI on clean energy returns are positive and substantially larger in absolute terms than the effect on technology returns, which is slightly negative but close to zero. This indicates that clean energy stock prices show a much stronger response to physical risk shocks than technology stocks. The asymmetric return response can plausibly result in a temporarily reduced near-term correlation. As discussed in the previous section, the existing literature on climate finance suggests a negative relationship between stock returns and exposure to climate risks. Since clean energy firms should have an overall higher negative exposure to climate risks than technology companies, their returns react more positively in response to climate risk shocks. In a short-term setting, this could be particularly true for physical risks that immediately raise the investors’ attention and affect their beliefs about climate change (Choi et al., 2020; Alekseev et al., 2022). Results of Alekseev et al. (2022) indicate that investors tend to buy stocks after a physical climate risk shock (e.g., extreme heat events) that could profit from climate change by likely changing consumer preferences and regulations, for example.

Although the difference in return reactions to PRI is relatively large, the absolute daily response of clean energy stocks to physical climate risk shocks is still small. This is also reflected in PRI’s small but significant effect on the one-day-ahead correlation of technology and clean energy stocks, as found in Sect. 4.2.

Overall, our analysis shows that physical and transition risks can have disparate effects on stock prices, which also depend on the time horizon. This further underlines the need to unravel both types of climate change risk in future research, as also demanded by Giglio et al. (2021).

5 Conclusions

This paper offers a novel discussion on the interlinkages between clean energy stocks, technology stocks, and risks related to climate change. Since the need for a technology-based energy transition to curb the repercussions of climate change might be perceived more urgent with increasing climate risks, the latter can be a key determinant of the connection between clean energy and technology stocks. Therefore, we examine the long- and short-term correlation dynamics of clean energy and technology equity indices. Unlike previous studies that focus on the role of oil prices, we explicitly investigate whether the return nexus of both sectors is affected by shocks to physical and transition climate risks.

We use the news-based physical (PRI) and transition (TRI) risk indices of Bua et al. (2022). First, we estimate the impact of physical and transition risk on the time-varying long-term correlation between clean energy and technology stocks using DCC-MIDAS (Colacito et al., 2011; Conrad et al., 2014). Second, we assess the effect of PRI and TRI on the short-term, i.e., daily correlation dynamics estimated via DCC-GARCH and rolling window correlations. Our results demonstrate that an increase in physical and transition risks contributes to a higher long-term correlation between clean energy and technology stocks. We find a more robust effect originating from transition risk, suggesting that, for instance, regulatory climate actions may contribute stronger to an intensified long-term connectedness between both sectors than actual physical climate hazards. However, in the short run, physical risk is negatively related to daily correlations, while transition risk appears less relevant. Our findings indicate that this is due to a higher sensitivity of clean energy stock returns to physical climate risk. Technology stock returns show smaller short-term reactions to physical risk shocks, resulting in a temporarily decreased correlation. We control for a number of covariates, including market volatility, economic policy uncertainty, business cycle variations, and oil price changes. By comparing the results for PRI and TRI with the climate risk indices of Engle et al. (2020) and Gavriilidis (2021), we further demonstrate the importance of differentiating between transition and physical climate risks.

The identified effects of physical and transition risk on the short- and long-term relationship between clean and technology stocks are potentially helpful for investment decisions. The co-movement between clean energy and technology stocks and its positive association with transition risks suggests that stocks of the two sectors are moving closer together over the long run, e.g., in response to new climate-related regulations, thereby affecting the level of portfolio diversification. Thus, investors should carefully evaluate transition and physical climate risks when making inferences on the long-term correlation between clean energy and technology stocks for asset allocation, portfolio optimization, and risk management. Our findings can also have important policy implications. Sadorsky (2012) points out a potential dilemma for investors, who might be inclined to invest in technology stocks rather than clean energy firms, since both are highly correlated, but the latter are generally considered a more risky investment. Our results reinforce this concern, as the correlation is expected to increase in the future with further increased climate risks. Regulators may need to keep an eye on it and, if necessary, ensure an appropriate investment environment for the clean energy sector.

Our work leaves scope for future research. Future studies can, for example, revisit findings on the nexus of oil prices, technology, and clean energy stocks to explore return and risk spillovers under the explicit consideration of climate-related risks.

Notes

We are not concerned that the availability of the data on the climate risk indices, which restricts our sample to begin in 2005, poses a problem for our research question. As Giglio et al. (2021) argue, climate risk has just recently gained a large amount of attention from investors and, therefore, has been priced in financial markets only in the near past, as indicated by the related empirical literature. For example, Bua et al. (2022) find an emerging climate risk premium for European stocks since 2015 but not before. Also, compared to recent years, the need for an energy transition and, thus, technology-based clean energy firms was generally not deemed as urgent many years ago.

We use U.S. stock market indices in our main empirical analysis since a representative clean energy stock market index does not exist for European companies. Although PRI and TRI are built from Reuters news with a European regional focus, they convey information on climate risks that is not exclusively relevant to European firms. The news articles that led to the largest shocks in climate risk are mostly of global relevance, as shown in Bua et al. (2022). They cover topics such as melting glaciers, permafrost thawing ocean acidification, sea level rise, Kyoto Protocol-related news, and even U.S. emission regulations. Although some news may seem only locally relevant, they directly affect U.S. firms operating in Europe. We also conduct an analysis with European technology and global clean energy stock indices and discuss the robustness of our U.S.-findings in the results section.

Both stock indices cover a different set of firms. We identified merely two stocks during the past 10 years that were held by both the Invesco WilderHill Clean Energy ETF and the HighMark NYSE Arca Tech 100 Index Fund.

In the original DCC specification of Engle (2002), the long-term correlation is given by the constant unconditional expectation of \(q_{ij,t}\).

Our findings remain qualitatively unchanged for different lags of the DCC-MIDAS ranging from 24 up to 60 months.

Unlike climate risks, monthly oil returns are not a significant determinant of the long-term correlation between clean energy and technology stocks, as suggested by the DCC-MIDAS. This result holds for the spot and front-month futures prices of WTI crude oil.

DCC-MIDAS parameter estimates for CPU, WSJ, and CHNEG as well as PRI and TRI over equivalent sample periods are presented in Table 6.

DCC-MIDAS parameter estimates for a lag length of \(K= 36\) months can be found in Table 6.

The correlation between technology and clean energy stocks is stationary according to an ADF test with a p-value below 1%.

We also consider WTI front-month futures returns, which does not change our results.

We also run our regression model for percentage changes of correlation. The results are presented in Table 7 and remain qualitatively the same for lag one. For example, a one standard deviation shock in PRI reduces the next day’s DCC by about 0.26% per day. For longer lags, the parameters are still negative, but mostly insignificant. However, we find only a weakly significant coefficient for PRI lagged by three trading days when the correlation is estimated over a rolling window. Shorter lags are insignificant.

For the correlation of European technology and global clean energy stock markets, signs for the coefficients of PRI (mainly negative) and TRI (mainly positive) remain the same in our regression model. However, in contrast to the U.S. indices, we do not find consistently significant effects of PRI on DCC and RWC. Instead, three-day-lagged TRI positively affects RWC, which is, however, not confirmed when using DCC. These findings hold if S &P 500 returns and VIX levels as controls are replaced by returns of the Euro Stoxx 50 and levels of the VSTOXX.

Parameter estimates for lagged log changes in the WTI crude oil spot price are presented in Table 8. We find no significant parameters for log price changes in WTI front-month futures contracts.

References

Adams, Z., Collot, S., & Kartsakli, M. (2020). Have commodities become a financial asset? Evidence from ten years of financialization. Energy Economics, 89, 1–20. https://doi.org/10.1016/j.eneco.2020.104769

Adams, Z., & Glück, T. (2015). Financialization in commodity markets: A passing trend or the new normal? Journal of Banking and Finance, 60, 93–111. https://doi.org/10.1016/j.jbankfin.2015.07.008

Addoum, J. M., Ng, D. T., & Ortiz-Bobea, A. (2020). Temperature shocks and establishment sales. The Review of Financial Studies, 33, 1331–1366. https://doi.org/10.1093/rfs/hhz126

Alekseev, G., Giglio, S., Maingi, Q., Selgrad, J., & Stroebel, J. (2022). A quantity-based approach to constructing climate risk hedge portfolios (NBER working paper series, no. 30703). https://doi.org/10.3386/w30703

Ardia, D., Bluteau, K., Boudt, K., & Inghelbrecht, K. (2022). Climate change concerns and the performance of green vs. brown stocks. Management Science, Articles in Advance. https://doi.org/10.1287/mnsc.2022.4636

Aromi, D., & Clements, A. (2019). Spillovers between the oil sector and the S &P500: The impact of information flow about crude oil. Energy Economics, 81, 187–196. https://doi.org/10.1016/j.eneco.2019.03.018

Aruoba, S. B., Diebold, F. X., & Scotti, C. (2009). Real-time measurement of business conditions. Journal of Business & Economic Statistics, 27, 417–427. https://doi.org/10.1198/jbes.2009.07205

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. Quarterly Journal of Economics, 131, 1593–1636. https://doi.org/10.1093/qje/qjw024.Advance

Baldauf, M., Garlappi, L., & Yannelis, C. (2020). Does climate change affect real estate prices? Only if you believe in it. The Review of Financial Studies, 33, 1256–1295. https://doi.org/10.1093/rfs/hhz073

Bansal, R., Ochoa, M., & Kiku, D. (2016). Climate change and growth risks (NBER working paper series, no. 23009). https://doi.org/10.3386/w23009

Barnett, M. (2023). Climate change and uncertainty: an asset pricing perspective. Management Science, Articles in Advance. https://doi.org/10.1287/mnsc.2022.4635

Bolton, P., & Kacperczyk, M. (2021). Do investors care about carbon risk? Journal of Financial Economics, 142, 517–549. https://doi.org/10.1016/j.jfineco.2021.05.008

Bondia, R., Ghosh, S., & Kanjilal, K. (2016). International crude oil prices and the stock prices of clean energy and technology companies: Evidence from non-linear cointegration tests with unknown structural breaks. Energy, 101, 558–565. https://doi.org/10.1016/j.energy.2016.02.031

Breitenstein, M., Anke, C.-P., Nguyen, D. K., & Walther, T. (2022). Stranded asset risk and political uncertainty: the impact of the coal phase-out on the German coal industry. The Energy Journal, 43, 27–50. https://doi.org/10.5547/01956574.43.5.mbre

Breitenstein, M., Nguyen, D. K., & Walther, T. (2021). Environmental hazards and risk management in the financial sector: A systematic literature review. Journal of Economic Surveys, 35, 512–538. https://doi.org/10.1111/joes.12411

Brogaard, J., & Detzel, A. (2015). The asset-pricing implications of government economic policy uncertainty. Management Science, 61, 3–18. https://doi.org/10.1287/mnsc.2014.2044

Bua, G., Kapp, D., Ramella, F., & Rognone, L. (2022). Transition versus physical climate risk pricing in European financial markets: A text-based approach (ECB working paper series, no. 2677). https://doi.org/10.2139/ssrn.4154034

Büyükşahin, B., & Robe, M. A. (2014). Speculators, commodities and cross-market linkages. Journal of International Money and Finance, 42, 38–70. https://doi.org/10.1016/j.jimonfin.2013.08.004

Cepni, O., Demirer, R., & Rognone, L. (2022). Hedging climate risks with green assets. Economics Letters, 212, 110312. https://doi.org/10.1016/j.econlet.2022.110312

Choi, D., Gao, Z., & Jiang, W. (2020). Attention to global warming. The Review of Financial Studies, 33, 1112–1145. https://doi.org/10.1093/rfs/hhz086

Colacito, R., Engle, R. F., & Ghysels, E. (2011). A component model for dynamic correlations. Journal of Econometrics, 164, 45–59. https://doi.org/10.1016/j.jeconom.2011.02.013

Conrad, C., Loch, K., & Rittler, D. (2014). On the macroeconomic determinants of long-term volatilities and correlations in U.S. stock and crude oil markets. Journal of Empirical Finance, 29, 26–40. https://doi.org/10.1016/j.jempfin.2014.03.009

Dudda, T., Klein, T., Nguyen, D. K., & Walther, T. (2022). Common drivers of commodity futures? (Queen’s management school working paper, no. 2022/05). https://doi.org/10.2139/ssrn.4231994

Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50, 987. https://doi.org/10.2307/1912773

Engle, R. (2002). Dynamic conditional correlation. Journal of Business & Economic Statistics, 20, 339–350. https://doi.org/10.1198/073500102288618487

Engle, R. F., Giglio, S., Kelly, B., Lee, H., & Stroebel, J. (2020). Hedging climate change news. The Review of Financial Studies, 33, 1184–1216. https://doi.org/10.1093/rfs/hhz072

Faccini, R., Matin, R., & Skiadopoulos, G. (2023). Dissecting climate risks: Are they reflected in stock prices? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3795964

Fahmy, H. (2022). The rise in investors’ awareness of climate risks after the Paris Agreement and the clean energy-oil-technology prices nexus. Energy Economics, 106, 105738. https://doi.org/10.1016/j.eneco.2021.105738

Ferrer, R., Shahzad, S. J. H., López, R., & Jareño, F. (2018). Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Economics, 76, 1–20. https://doi.org/10.1016/j.eneco.2018.09.022

Flori, A., Pammolli, F., & Spelta, A. (2021). Commodity prices co-movements and financial stability: A multidimensional visibility nexus with climate conditions. Journal of Financial Stability, 54, 100876. https://doi.org/10.1016/j.jfs.2021.100876

Gavriilidis, K. (2021). Measuring climate policy uncertainty. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3847388

Ghysels, E., Sinko, A., & Valkanov, R. (2007). MIDAS regressions: Further results and new directions. Econometric Reviews, 26, 53–90. https://doi.org/10.1080/07474930600972467

Giglio, S., Kelly, B., & Stroebel, J. (2021). Climate finance. Annual Review of Financial Economics, 13, 15–36. https://doi.org/10.1146/annurev-financial-102620-103311

Glosten, L. R., Jagannathan, R., & Runkle, D. E. (1993). On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance, 48, 1779–1801. https://doi.org/10.1111/j.1540-6261.1993.tb05128.x

Henriques, I., & Sadorsky, P. (2008). Oil prices and the stock prices of alternative energy companies. Energy Economics, 30, 998–1010. https://doi.org/10.1016/j.eneco.2007.11.001

Hsu, P., Li, K., & Tsou, C. (2023). The pollution premium. The Journal of Finance. https://doi.org/10.1111/jofi.13217

Inchauspe, J., Ripple, R. D., & Trück, S. (2015). The dynamics of returns on renewable energy companies: A state-space approach. Energy Economics, 48, 325–335. https://doi.org/10.1016/j.eneco.2014.11.013

Kocaarslan, B., & Soytas, U. (2019). Asymmetric pass-through between oil prices and the stock prices of clean energy firms: New evidence from a nonlinear analysis. Energy Reports, 5, 117–125. https://doi.org/10.1016/j.egyr.2019.01.002

Kumar, S., Managi, S., & Matsuda, A. (2012). Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis. Energy Economics, 34, 215–226. https://doi.org/10.1016/j.eneco.2011.03.002

Lundgren, A. I., Milicevic, A., Uddin, G. S., & Kang, S. H. (2018). Connectedness network and dependence structure mechanism in green investments. Energy Economics, 72, 145–153. https://doi.org/10.1016/j.eneco.2018.04.015

Lyocsa, S., & Todorova, N. (2023). Forecasting of clean energy market volatility: The role of oil and the technology sector. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4392175

Maghyereh, A. I., Awartani, B., & Abdoh, H. (2019). The co-movement between oil and clean energy stocks: A wavelet-based analysis of horizon associations. Energy, 169, 895–913. https://doi.org/10.1016/j.energy.2018.12.039

Meinerding, C., Schüler, Y. S., & Zhang, P. (2023). Shocks to transition risk (Deutsche Bundesbank discussion paper, no. 04/2023). https://doi.org/10.2139/ssrn.4391260

Painter, M. (2020). An inconvenient cost: The effects of climate change on municipal bonds. Journal of Financial Economics, 135, 468–482. https://doi.org/10.1016/j.jfineco.2019.06.006

Pankratz, N., Bauer, R., & Derwall, J. (2023). Climate change, firm performance, and investor surprises. Management Science, Articles in Advance. https://doi.org/10.1287/mnsc.2023.4685

Pástor, L., & Veronesi, P. (2013). Political uncertainty and risk premia. Journal of Financial Economics, 110, 520–545. https://doi.org/10.1016/j.jfineco.2013.08.007

Popp, D. (2011). International technology transfer, climate change, and the clean development mechanism. Review of Environmental Economics and Policy, 5, 131–152. https://doi.org/10.1093/reep/req018

Qu, F., Chen, Y., & Zheng, B. (2021). Is new energy driven by crude oil, high-tech sector or low-carbon notion? New evidence from high-frequency data. Energy, 230, 120770. https://doi.org/10.1016/j.energy.2021.120770

Reboredo, J. C., Rivera-Castro, M. A., & Ugolini, A. (2017). Wavelet-based test of co-movement and causality between oil and renewable energy stock prices. Energy Economics, 61, 241–252. https://doi.org/10.1016/j.eneco.2016.10.015

Sadorsky, P. (2012). Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Economics, 34, 248–255. https://doi.org/10.1016/j.eneco.2011.03.006

Saeed, T., Bouri, E., & Alsulami, H. (2021). Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Economics, 96, 105017. https://doi.org/10.1016/j.eneco.2020.105017

Stern, N., & Stern, N. H. (2007). The economics of climate change: the Stern review. Cambridge University Press.

Sun, C., Ding, D., Fang, X., Zhang, H., & Li, J. (2019). How do fossil energy prices affect the stock prices of new energy companies? Evidence from Divisia energy price index in China’s market. Energy, 169, 637–645. https://doi.org/10.1016/j.energy.2018.12.032

TCFD. (2017). Recommendations of the Task Force on Climate-related Financial Disclosures (Technical report, task force on climate-related financial disclosures).

Uddin, G. S., Rahman, M. L., Hedström, A., & Ahmed, A. (2019). Cross-quantilogram-based correlation and dependence between renewable energy stock and other asset classes. Energy Economics, 80, 743–759. https://doi.org/10.1016/j.eneco.2019.02.014

van Benthem, A. A., Crooks, E., Giglio, S., Schwob, E., & Stroebel, J. (2022). The effect of climate risks on the interactions between financial markets and energy companies. Nature Energy, 7, 690–697. https://doi.org/10.1038/s41560-022-01070-1

Yahya, M., Kanjilal, K., Dutta, A., Uddin, G. S., & Ghosh, S. (2021). Can clean energy stock price rule oil price? New evidences from a regime-switching model at first and second moments. Energy Economics, 95, 105116. https://doi.org/10.1016/j.eneco.2021.105116

Zhang, G., & Du, Z. (2017). Co-movements among the stock prices of new energy, high-technology and fossil fuel companies in China. Energy, 135, 249–256. https://doi.org/10.1016/j.energy.2017.06.103

Funding

No funding was received for conducting this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank the guest editor Ramzi Benkraiem and two anonymous reviewers for valuable suggestions leading to an improvement of this article.

Appendices

Appendix A: Glossary

See Appendix Table 5.

Appendix B: Robustness

See Appendix Tables 6, 7 and 8.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bouri, E., Dudda, T.L., Rognone, L. et al. Climate risk and the nexus of clean energy and technology stocks. Ann Oper Res (2023). https://doi.org/10.1007/s10479-023-05487-z

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-023-05487-z