Abstract

Strategies to increase sustainability are of growing relevance for supply chains and especially for the management of production processes. In this paper, we build on existing literature in closed-loop supply chain management and consider a two-period game-theoretic model in which product returns are reused in the manufacturing process. In all scenarios, we assume that the return rate of used products is random and not known to the players at the beginning of the planning horizon, thus, they have to deal with uncertainty in period 1. In contrast to existing literature, we will also address the circumstance that the players’ level of information in period 2, after the returns have been realized, can be linked to the collection mode in the supply chain. In Scenario A, the retailer is involved in the collection of the used products and transfers them to the manufacturer, so that symmetric information is available. In Scenario B, on the other hand, the used products reach the manufacturer directly from the customer, so that the manufacturer has an information advantage over the retailer. By comparing these scenarios and a vertically integrated supply chain benchmark case, it becomes clear that, depending on the actual return rate, the presence of private information can be either beneficial or detrimental to the manufacturer. The retailer, on the other hand, can compensate for information disadvantages in most cases over the multi-period planning period due to its position as a Stackelberg leader. Regardless of the amount of a transfer payment offered to it by the manufacturer, it prefers the collection of the goods by the manufacturer itself. These findings contribute to literature on symmetric information, where, for example, a retailer-led collection is preferred (Savaskan et al. Manage Sci 50(2):239–252, 2004) or the decision depends on the amount of the transfer payment (Modak et al. J Clean Prod 171:512–528, 2018). However, we show that cooperation between the players leads to the best results not only economically but also from an ecological point of view.

Similar content being viewed by others

1 Introduction

Climate change and the growing scarcity of resources are resulting in sustainable production processes becoming increasingly important. The analysis of so-called closed-loop supply chains (CLSCs), in which reverse flows are considered in addition to the standard forward flows in the supply chain, is therefore gaining greater research attention. In CLSCs, the focus is on the entire life cycle of a product (Guide and Van Wassenhove 2009).

Remanufacturing or recycling processes often play a key role in CLSCs. One reason for this is that legislation increasingly requires the integration of reverse flows in companies and the take-back of old products in some industries. For example, as described in Germany’s Closed Substance Cycle and Waste Management Act, product and waste responsibility is devolved to individual companies. The Waste from Electrical and Electronic Equipment (WEEE) Directive, on the other hand, is a directive of the European Union that is intended to help reduce waste in the electronic-equipment sector. According to the Global E-waste Monitor 2020 (Forti et al. 2020), the world generated 53.6 million tons of e-waste in 2019. Only about 17% of this e-waste was documented to have been properly collected and recycled. However, this value varies greatly by region. In Europe, for example, over 42% of e-waste is collected and recycled. This highlights the importance of such legislation as the WEEE Directive. Furthermore, the incentives for voluntarily implementing remanufacturing and recycling processes have become significant enough in many industries that companies choose to initiate them on their own. On the one hand, returning used products to the production cycle can be instrumental in responding to increasing consumer and societal demand for green products (Atasu et al. 2008). According to a study by The Nielsen Company (2015), about three out of four respondents from the younger generation are willing to pay more for products that come from sustainable companies. On the other hand, such decisions can be economically motivated. Rising energy costs and prices for raw material can be identified as the main drivers for remanufacturing decisions. According to a study of the Association of German Engineers (Verein Deutscher Ingenieure - or VDI), in the manufacturing sector, material costs are reported to account for an average of 40% of total costs and, thus, represent the largest pool of expenditures. By reusing parts from end-of-life products, there may, therefore, be financial benefits for companies. If adequate conditions are met, the procurement costs of remanufactured products can be about 40% to 80% lower than those of equivalent new products. In European companies most of the used products are remanufactured in the field of electronic/electrical equipment (EEE) and in the automotive industry (Lange 2018).

In contrast to remanufacturing, recycling does not aim to reuse entire components but rather raw materials. Especially in regard of electronic devices such as laptops and smartphones, recycling can be considered economical as the materials contained, for example, gold, silver, and palladium, have undergone strong price increases or scarcity in the past, which makes e-waste an important source of raw material (Esenduran et al. 2019). Another example is recycling printer cartridges, which is also common. It is estimated that for 100,000 recycled printer cartridges, 9,599 kg of aluminum, 40 tons of plastic, and 1,000,000 ls of oil can be saved (Ding et al. 2020); this is one reason manufacturers like Hewlett-Packard (hereafter, HP) choose to recycle used cartridges. The company reports that 82% of original HP ink cartridges contain 45–70% recycled plastic (HP Developement Company 2022). According to the sustainability manager for HP’s Germany, Austria and Switzerland regions, collecting and recycling empty ink and toner cartridges is the most economical and environmentally friendly option. Water and \(\text {CO}_2\) consumption can each be reduced by 40% and energy consumption by 60%. Raw-material recycling is, thereby, preferable to refilling empty cartridges for economic as well as ecological and quality reasons (paperworld Remanexpo 2022). Xerox, another manufacturer of printing supplies, reports savings of several millions of dollars in material costs by reusing old toner cartridges (Xerox 2018).

Still, the specific numbers regarding energy and resource savings can vary from industry to industry. For example, energy consumption in the furniture sector is said to be reduced by up to 100% through remanufacturing. For a complete overview, see Fraccascia et al. (2019).

However, not only are the remanufacturing/recycling processes themselves important but also the collection processes, as the company has to acquire end-of-life products from the consumers. In practice, there are various approaches for reintroducing end-of-life products into the production process. For example, for electronic devices that are affected by the above-mentioned WEEE Directive, it is common to hand them in at central collection points such as recycling centers. Retailers with a sales area of more than 400 square meters may also be obliged to accept used electronic equipment in Germany. Regardless of this, retailers might also take back used items voluntarily. According to Best Buy, e.g., the company was involved in the collection of more than two billion tons of e-waste so far, making it the largest collector of e-waste in the United States (Best Buy 2022).

Alternatively, returns can be made directly to the manufacturer. Direct product returns are common practice, for example, in the area of consumables for printers and copiers (HP Developement Company 2022; Ricoh Europe 2022). In the sector of small electronic devices, such as laptops, monitors, and smartphones, manufacturers also offer mail-back recycling programs, in which old products can be sent to the manufacturers by postal mail (Apple 2022; Lenovo 2022). As reported by Guide (2000), a majority of firms prefer this collection mode.

In those cases where returns are handled directly by the manufacturer and without retailer participation, it is possible that not all members in the supply chain, e.g., retailers, are aware of the quantities returned, resulting in information differences within the supply chain. However, even to the companies involved in the collection, future returns are often not known in advance, i.e., at the beginning of the planning horizon. As reported by Guide (2000), 61.5% of firms report uncertainty about the timing or the quantity of returns.

CLSCs under certain and symmetric information are well examined. However, due to the importance of the return rate for the costs of a company and thus also the pricing policy of the actors, the circumstance of having an uncertain return rate should be addressed in supply chain models as well. Although there exists literature that models the return rate as a random parameter, there is currently no linkage of uncertainties and asymmetric information to the collection process itself. In our paper, therefore, we investigate a simple supply chain model, consisting of a manufacturer and a retailer. Using game-theoretic methods, we examine how the integration of used products affects the pricing strategies of the players within a two-period planning horizon. We assume the return rate to be a random parameter whose value is not known to the members of the supply chain at the time of first decision making. In contrast to the static games considered in the majority of papers, we situate our model in a multi-period context to separate forward and backward flows in time. In the course of the first period the customers have then the option to return their used products. Depending on the specific model scenario, either the manufacturer or the retailer is responsible for their collection. Under a manufacturer-led collection mode, the retailer has an information disadvantage compared to the manufacturer in period 2, i.e., information asymmetries occur within the supply chain. If the retailer collects the used items, both supply chain members are equally informed about the return rate instead. With the intention of closing a gap in the literature, we thereby address the circumstance that the players’ level of information regarding the return rate can be linked to the collection mode after the returns have been realized. We further assume that returns can reduce the production cost per unit in period 2 compared to period 1 as the manufacturer reuses them in the production process. Depending on the collection strategy and thus occurring information structures, the second period pricing decisions of the players can thus be affected by the product returns. Due to the increased complexity associated with this model extension, we limit ourselves, without loss of generality, to a planning horizon of two periods. In our paper, therefore, we aim to answer the following research questions:

-

1.

How do uncertainty about the return rate and different collection mode dependent information structures affect pricing within the CLSC in both periods?

-

2.

In which situations do the players have advantages or disadvantages from information differences between them and how do those affect their channel preferences?

-

3.

How are CLSC activities affected by the different collection modes?

The remainder of this paper is organized as follows. In Sect. 2, we provide a review of the related literature. The fundamentals of the game-theoretic model analyzed in this paper are described in Sect. 3. We consider three different model sceanarios which are a retailer-led collection, a manufacturer-led collection and a vertically integrated supply chain. These model variants including profit functions and solutions are presented in Sect. 4. All scenarios are compared numerically in Sect. 5 to gain managerial insights. Section 6 concludes the paper. All mathematical proofs and supplementary material is presented in the Appendix.

2 Literature review

By answering the research questions above, our analysis aims to contribute to the existing research in several ways. Because of the topicality and significance of the research area, there are already numerous publications in the field of CLSCs, and new ones are constantly being added. Within the scope of this literature review, we can therefore focus only on research that is most closely related to our paper. This mainly includes studies that examine the advantageousness of different reverse channels, as well as uncertainties about the return rate in CLSCs or information asymmetries in a game-theoretic context. For a general overview on CLSCs, see, e.g., Souza (2013); Stindt and Sahamie (2014); Govinda et al. (2015); Simonetto et al. (2022); Mishra et al. (2023) or for relatedness of open- and closed-loop supply chains see Berlin et al. (2022).

Basically, the literature agrees that remanufacturing is profitable and that the manufacturer, therefore, has an incentive to integrate recovery processes into the supply chain (Ferrer and Swaminathan 2006). Early CLSC literature in the area of game theory typically considers models in which players act under complete information and the rate of return is either a given parameter or a decision variable of the players. The topic of interest here is, for example, who should collect the used products: the manufacturer, the retailer, or a third party, as examined in Savaskan et al. (2004), Savaskan and Van Wassenhove (2006) and Modak et al. (2018). Wu and Zhou (2017) extended the model of Savaskan et al. (2004) and considered supply chain competition, whereas Modal et al. (2022) include Corporate Social Responsibility activities and government subsidies in their analyses. Also in our paper, we investigate different collection strategies, meaning either the manufacturer or the retailer being in charge. In Genc and De Giovanni (2018) and Zhang and Xiong (2017), e.g., the reverse channel is operated only by a manufacturer. In Bhattacharya et al. (2006), the remanufacturer is solely responsible for the collection of used items. Contrary to this, in Zhao and Zhu (2017) the retailer collects the products and gives them to a remanufacturer. Asghari et al. (2022), e.g., considered a third party that is responsible for collecting used items and they assume that advertising has an impact on the quantity returned.

Profit maximization, and associated pricing decisions, are thereby of fundamental interest of a large portion of the CLSC literature, as also, e.g., in the work of Esenduran et al. (2019). The authors also considered the option of the collection process being performed jointly by the manufacturer and the retailer. Pan and Lin (2021) examined pricing decisions under cross-channel recycling. Liu et al. (2020) differentiated between centralized and decentralized pricing models and integrate quality issues into their study. Two different pricing strategies are analyzed by Wen et al. (2020). In the first one, equal prices are set for new and remanufactured products, while in the second one, different prices are set. They find that equal pricing can be beneficial, if, e.g., the proportion of green customers is high. Johari and Hosseini-Motlagh (2019) considered not only pricing decisions but also investments by the remanufacturer in corporate social responsibility efforts. There are several studies that integrate uncertainty into their considerations, for example, regarding prices or demand, see, e.g., Fathollahi-Fard et al. (2021); Liu et al. (2022).

In this paper, however, we assume that the return rate is a random parameter and is unknown at the beginning of the planning horizon. Masoudipour et al. (2017) addressed the problem of modeling the return rate, which is often subject to uncertainties. In addition, Guide (2000) examined the issue of the uncertainty of returns as a cause of the uncertain nature of a product’s life cycle. In practice as well, the return rate can only be predicted to a limited extent as it can easily be influenced by, for example, government- or company-driven measures. Aras et al. (2004) addressed this uncertainty and considered returns as a stochastic Poisson process. For a general overview on different types of return rates used in closed-loop supply chain literature, please see also De Giovanni and Zaccour (2022).

With the intention of closing a gap in the literature, we consider both uncertainty and information differences within a CLSC under different collection modes. As in practice, perfect knowledge about other supply chain members is not always available. How private information affects the supply chain members’ decisions has been well-studied in literature. For an overview of supply chain models that include information considerations such as demand-information updating, supply-information updating, and information asymmetry in studies, see Shen et al. (2019). However, in CLSC contexts, the literature also increasingly considers games with asymmetric information, although these are less well-established than those analyzing forward supply chains. The topics of interest are manifold here. Wang et al. (2022), e.g., consider a CLSC with asymmetric information of corporate social responsibility and sales effort cost. In the research of De Giovanni (2017), there is asymmetric information concerning a profit-sharing parameter. In the work of Huang and Wang (2017), a distributor has private market demand information. However, in our literature review, we want to focus on asymmetric information regarding the return rate or associated costs of remanufacturing. In Wei et al. (2015), for example, it is assumed that the manufacturing and remanufacturing costs are known only to the manufacturer and that a demand and cost-scaling parameter is known only to the retailer. The collection rate is a decision variable. In addition to the model variants of symmetric and asymmetric information, the authors also examined the impact of the assumed power structure in the supply chain on prices and collection rates. Similarly, Zhao et al. (2017) analyzed a fuzzy CLSC in which the retailer’s collecting scale parameter is private information and the retailer determines the optimal collection rate. Suvadarshini et al. (2023) considered asymmetric information concerning a cost coefficient of recollection agents. In Zhang et al. (2014), a contract design problem was studied where a collection-efficiency parameter is known only to the retailer; in Zhang et al. (2020) it is a recovery-cost parameter of two competing retailers under a reward-penalty mechanism. Wang et al. (2018) analyzed a CLSC in which a retailer and a third-party recycler compete with each other. Both parties have private information regarding their collection efforts. Li et al. (2014) designed a contract to overcome inefficiencies resulting from asymmetric information about the collector’s cost in a CLSC. In Wang et al. (2017), for example, the retailer’s collection-effort level is private information, and a screening contract under the influence of a reward-penalty mechanism is developed. Gong et al. (2011) assumed the retailer’s operating cost to be unknown to the manufacturer. Zhang and Xiong (2017) analyzed a CLSC setting in regard to whether to share demand forecast information, which they found to be advantageous for the retailer when the manufacturer’s collection efficiency is high. Yang et al. (2014) analyzed a single-period model in the area of consumer returns. In this scenario, the retailer possesses private knowledge regarding a return rate. For example, if customers are dissatisfied with the product, they can return the product and receive a refund. However, this research doesn’t constitute a CLSC, meaning no remanufacturing occurs. The authors presented a contract with which the manufacturer can overcome its information deficits.

The main difference in considering private information about the cost parameters examined in the literature and the uncertainty we consider about the return rate, which in turn indirectly influences costs, is that there is uncertainty throughout the supply chain at the beginning of the planning horizon. Even the manufacturer can only estimate its future costs in the first period. Only when the returns are available at the beginning of the second period does the manufacturer have certainty about the returns and, thus, production costs. Depending on the collection mode, the retailer may also be informed about the returns then. Thus, differently from existing literature, we additionally link the information levels of the players to the collection modes.

Furthermore, the differences in knowledge about the returned quantity over time make it necessary to consider a two-period game-theoretic model. The analysis of two-period CLSC models is also important in the existing literature as it allows the separation of forward flows and reverse flows in time within a dynamic setting. All the previously cited papers focus instead on a single-period static setting. In multi-period models, it is of interest, for example, to examine how green activity programs (De Giovanni and Zaccour 2014), quality (Genc and De Giovanni 2017), or advertising (Ramani and De Giovanni 2017; Mondal and Giri 2020) influence decisions in the CLSC. Genc and De Giovanni (2018) analyzed consumer behavior in a two-period CLSC under different types of rebate mechanisms. In their study, they assume that the return rate depends on a rebate that customers are given for returning a product and the selling price of new items. In Wang et al. (2018), a reward-penalty mechanism is considered, when in the second period, used products are collected and remanufactured. They found that the reward-penalty mechanism could be beneficial in terms of closed-loop supply chain activities. Tang et al. (2020) analysed different warranty models in a CLSC, i.e., warranties for new and remanufactured products or new products only. Ferrer and Swaminathan (2006) studied a multi-period monopoly as well as a duopoly environment in which a manufacturer produces new and remanufactured products. Debo et al. (2005) also examined a multi-period model in which a manufacturer decides on a remanufacturability level of the products. All these papers have in common the consideration of symmetric information cases. In De Giovanni (2017), by contrast, a multi-period CLSC with asymmetric information is considered where the manufacturer may have private information about its profit-sharing parameter. The return rate is certain and depends on the customers’ environmental consciousness. In Mohammed et al. (2017) a multi-period model under different carbon policies is considered, but the demand and return rate as well as carbon emissions are uncertain here.

Table 1 presents a comparison of the key elements of our paper to those of the literature most-closely related to. We contribute to the literature by combining the research concerning the collection modes under certainty and symmetric information with the analysis of the players’ associated information levels. First, we take into account that information regarding the return rate is often unknown to the members of the supply chain at the beginning of the planning horizon, and thus uncertainty is present. Hence, we create closeness to practice where not only the supply chain partners but also the companies themselves have to deal with uncertainties regarding returns. Depending on the collection mode, symmetric information (retailer-led collection) or asymmetric information (manufacturer-led collection) can then be present in the second period. To the best of our knowledge, despite its relevance for practice, the impact of the different collection modes on the information levels of the players within a two-period planning horizon has not been analyzed so far. By intending to narrow this research gap, we present a two-period CLSC model under uncertainty and collection mode dependent information structures in the following. This provides us with novel insights into the choice of the optimal collection mode from the perspective of individual actors. Additionally, this allows us to shed light on the influence of players’ information level on CLSC activities and sustainability aspects in the CLSC.

3 Fundamentals of the two-period CLSC model

In the following, we address fundamental assumptions regarding the model scenarios under consideration. All notations used in this paper are summarized in Table A1 in Appendix 1. We normalize all input parameters to values between 0 and 1, which simplifies the mathematical analysis without sacrificing the fundamental model relationships, see, e.g., Zheng et al. (2021), Debo et al. (2005), De Giovanni and Zaccour (2014), Vorasayan and Ryan (2006).

Furthermore, the model is described as follows:

-

We consider a two-echelon supply chain consisting of a manufacturer M and a retailer R. We underlie a Stackelberg game (Von Stackelberg 1934) in which the retailer, as the leader, has the market power and moves first; the manufacturer is the follower. While early literature considering Stackelberg games usually placed the manufacturer in the lead position, retailer-led games are increasingly examined (see, e.g., Choi 1996; Giri and Maiti 2014; Xiao et al. 2014). Reasons for this include, for example, the increased presence of large retail chains and the growing number of brands, which puts retailers into a stronger position of power and makes it more difficult for manufacturers to win over large retailers (Choi 1996).

-

Three different scenarios, i, are examined, namely the case of symmetric information under a retailer-led collection (Scenario A), the case of asymmetric information under a manufacturer-led collection (Scenario B) and the case of a vertically integrated (VI) supply chain (Scenario C).

-

A two-period planning horizon is considered where each period represents a production cycle of the manufacturer. At the beginning of each period, the players announce their prices. When making their decisions, they take future profits into account, if available (see, e.g., Genc and De Giovanni 2017).

-

In both periods, the manufacturer produces the amount demanded by the customers, i.e., \(q^i_t\). Each unit is sold to the retailer at the wholesale price, \(w^i_t\). The retailer adds its margin, \(m^i_{Rt}\), to the wholesale price and sells the products to the customers (see, e.g., Choi 1996; Aust and Buscher 2012; Beranek and Buscher 2021). In the VI case (Scenario C), both parties cooperate and sell the products at an agreed-upon price, \(p_t^{C}\), to the customers (see, e.g., Modak et al. 2018).

-

Customers’ demand can be described by a linear demand function

$$\begin{aligned} q^i_t&= \alpha _t - \beta p_t^{i} \end{aligned}$$(1)where \(\alpha _t\) is the market potential of the corresponding period and \(\beta\) is the customer’s sensitivity to the retail price \(p_t^i\). In Scenarios A and B, the retail price equals \(p_t^i = w_t^i + m_{Rt}^i\), so that we obtain the following demand function:

$$\begin{aligned} q^i_t = \alpha _t - \beta \left( w_t^i + m_{Rt}^i\right) . \end{aligned}$$(2)Similar linear demand functions are widely used in the literature; see, e.g., Savaskan et al. (2004), Wei et al. (2015). As we consider the same type of customer throughout the different periods, we assume \(\beta\) to be independent of time (Genc and De Giovanni 2017). This assumption is common in the literature (see also, e.g., Dey and Saha 2018; Nielsen et al. 2019) as it allows the model complexity to be reduced. Should it be the case in practice that the price sensitivity of customers changes over time, integrating this time dependency into the model is unproblematic. It merely results in more-complex expressions for the optimal prices of the players. The fundamental statements and results of the paper do not change.

-

After the beginning of the first period, the manufacturer announces to the customers that they can return used and previously purchased products from now on. The manufacturer then uses these products, which are returned up until the beginning of the second period, in the next production cycle to save on production costs. We assume, therefore, that until the end of the first period, players do not know the exact quantity of the returns. Especially when reverse flows are integrated into the supply chain for the first time and no empirical data from the past are available, this is a reasonable assumption. Hence, we consider a game with uncertain information with regard to the return rate (see, e.g., Mohammed et al. 2017). At the beginning of the second period, the exact value of returns is either known to both players under a retailer-led collection (Scenario A) or private information of the manufacturer (Scenario B). In the case of a vertically integrated supply chain (Scenario C), naturally, no information asymmetries occur. In our model, the return rate, i.e., the fraction of first-period customers who return their product, is indicated by \(\theta\). We assume \(\theta\) to be a random variable and that it is common knowledge among all players that \(\theta\) is uniformly distributed with the probability density function, \(f(\theta )\), i.e., \(\theta \sim U[\phi _1,\phi _2]\) where \(\phi _1\) and \(\phi _2\) are the upper and lower limits of the interval, respectively, and \(f(\theta ) = \frac{1}{\phi _2 -\phi _1}\) for \(\phi _1 \le \theta \le \phi _2\), and 0 otherwise, which is a common assumption in literature on asymmetric information (see, e.g., Wang et al. 2017; Huang 2018; Ma et al. 2017).

-

We assume that, for every item returned, the collecting player (either the retailer - Scenario A or the manufacturer - Scenario B) incurs collection costs, \(c_c\), per unit, which may include, for example, shipping costs or reimbursements to the customers (see, e.g., Wang et al. 2018). Since collection costs are incurred during the first period but are not yet known at the time of first decision making, the collecting player does not know its total collection costs with certainty until the beginning of the second period. At the beginning of the planning horizon, both players, nevertheless, attempt to anticipate these future costs and take them into account when setting their prices.

-

In the case that the retailer is responsible for collecting the used items, the manufacturer can pay the retailer a transfer payment \(c_t\) for each product collected (see, e.g., Wei et al. 2015; Modak et al. 2018; Wang et al. 2018).

-

The manufacturer uses returned products for remanufacturing or recycling. We assume that this can reduce production costs in period 2, which is a common assumption in literature (see, e.g., Esmaeili et al. 2016; Wang et al. 2018). In period 1, production costs are \(c_m\) per item. To calculate the production costs of the second period, we assume a simplified cost function that depends on the quantity returned (see also, e.g., Savaskan et al. 2004; Savaskan and Van Wassenhove 2006; Wang et al. 2018, who apply similar approaches):

$$\begin{aligned} \left( 1- \delta \theta q^i_1\right) c_m. \end{aligned}$$(3)The higher the absolute number of returns, the lower the production costs in period 2. \(\delta\) describes the efficiency of the recycling process. First of all, the entire product is not always completely recyclable. In addition, remanufacturing or recycling itself can incur costs, although in the literature these are usually considered to be lower than the normal manufacturing costs (see, e.g., Savaskan et al. 2004; Liu et al. 2022; Wang et al. 2022). In our considered cost function, \(\delta\) can thus be seen as a scaling parameter that indicates the impact of the items returned on the production costs. We assume that \(\delta\) is less than 1 because, in reality, a product can usually never be reused in its entirety or at zero cost. As described in our introduction, printer cartridges, for example, are typically only partially made of recycled material. In regard to smartphones or laptops, similarly, the entire old device is not generally reused; however, valuable raw materials or some modules, for example, may be salvaged. It is assumed that all product returns are equally recyclable and that products made from new materials, remanufactured products, or products made from recycled materials do not differ in quality. This "as-good-as-new assumption" is common in the literature; see, e.g., Zhang et al. (2014), Wang et al. (2017), Mondal et al. (2020), Zhang et al. (2020), Wang et al. (2022). The British Standards Institution group further defines remanufacturing as the "process of returning a used product to at least its original performance with a warranty that is equivalent to or better than that of a newly manufactured product" (BSI 2010). In the case of recycled raw materials, it is also, in practice, impossible for customers in many cases to distinguish them from products without recycled materials. In the smartphone sector, for example, whether the components in a smartphone are made of recycled scrap gold is irrelevant to customers.

-

Without loss of generality, we assume that current and future profits are valued equally by the players, i.e., a discount factor of 1 is assumed, as done, for example, by Nielsen et al. (2019); Suvadarshini et al. (2023). This way, the impact of the second period strategies and different information levels in period 2 compared to period 1 is not distorted in the numerical analysis.

4 Three scenarios of pricing under collection mode dependent information levels

In order to be able to assess the effects of the different collection modes and the corresponding information levels in the CLSC on the players’ strategies, we perform a comparative analysis between a retailer-led collection (Scenario A) and a manufacturer-led collection (Scenario B) in the following. In addition, supply chain cooperation is considered in Scenario C. For this purpose, we determine the optimal expressions of the decision variables, i.e., the prices, for each scenario in this section.

4.1 Scenario A: symmetric information under retailer-led collection

In this model variant, the retailer is involved in the collection process, as it is the case, for example, at large retailers like Best Buy (Best Buy 2022). Also, for example, under the WEEE directive, retailers may be required to take over the collection of used products.

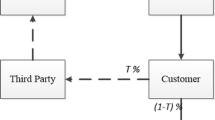

Here, the retailer acquires the used items at costs of \(c_c\) per unit and forwards them to the manufacturer. The manufacturer pays the retailer \(c_t\) per unit delivered (Modak et al. 2018). The resulting material and cash flows are illustrated in Fig. 1.

The manufacturer’s first period profit thus results from the revenues from the sales of the products to the retailer minus the payment \(c_t\) per unit returned to the retailer and minus the production costs. Since the return rate is a random parameter, the actual collection costs can only be quantified at the end of the first period. In the second period, the manufacturer can reduce its manufacturing costs compared to the first period due to the returns and associated recycling or remanufacturing. The retailer generates profits in both periods through the sales of products to customers. In this model variant, the retailer also incurs collection costs \(c_c\) in the first period which are compensated by the manufacturer’s payment \(c_t\). The players’ profit functions are therefore as follows:

In general, two-period games as the game at hand are solved via backward induction (Von Neumann and Morgenstern 1944), where the reaction functions of the players to the first-period decisions are determined first. These reaction functions are inserted into the first-period optimization problem, which is then solved optimally (De Giovanni and Zaccour 2014; Genc and De Giovanni 2017; Nielsen et al. 2019). This ensures that future profits are taken into account in current decision-making, i.e., from the first-period perspective. Thereby, the players must be aware of the uncertainties regarding future returns.

All detailed mathematical derivations are provided in the Appendix 2. We then obtain the following optimal pricing decisions of the players:

Proof: See Appendix 2.

4.2 Scenario B: asymmetric information under manufacturer-led collection

In Scenario B, the manufacturer is solely responsible for the collection of the used products. As shown in the introduction, this is the case, for example, at companies such as Apple or Lenovo (Apple 2022; Lenovo 2022), where customers send their products, like small electronic devices, to the manufacturers by mail. In our model, the manufacturer acquires the used items at costs of \(c_c\) per unit; the retailer is not involved in handling returns. The resulting material and cash flows are illustrated in Fig. 2.

Similarly to Scenario A, the manufacturer’s first period profit results from the revenues from the sales of the products to the retailer minus its production costs, but now no transfer payment to the retailer is necessary. The manufacturer has to bear the collection costs itself instead. Again, manufacturing costs can then be reduced in the second period compared to the first period. The retailer generates profit in both periods through the sales of products to the customers.

The players’ profit functions are therefore as follows:

Again, the game is solved via backward induction. Now, it has to be kept in mind that not only uncertainty about the return rate is present for both players from the perspective of the first period. In the second period, asymmetric information additionally occurs since the retailer is not involved in the collection of used products and thus the level of the return rate is only known to the manufacturer.

For the detailed mathematical derivations, please see the Appendix 3. We obtain the following optimal pricing decisions of the players:

Proof: See Appendix 3.

4.3 Scenario C: vertically integrated supply chain

In a vertically integrated supply chain, the manufacturer and the retailer cooperate and act as one party. The total profit of the supply chain is optimized (see also, e.g., Modak et al. 2018). The solution indicates the ideal profit that would, theoretically, be possible if the players did not each pursue their own goals but instead had an overall benefit in mind. When the players in the supply chain act in a vertically integrated manner, the channel profit equals the sum of the manufacturer’s and retailer’s profits. The only decision variables are the total retail prices \(p_1^{C}\) and \(p_2^{C}\), whereas the wholesale prices and margins are not relevant for the optimization anymore. Hence, please note that the demand function equals

in each period. Regardless of which of the parties would take over the collection of the products in practice, a possible transfer payment between the parties is also no longer relevant for optimization in the case of vertical integration, as it sums up to zero. The corresponding material and cash flows are illustrated in Fig. 3.

Then, the channel’s profit equals

As in the previous section, we apply backward induction to solve the game, taking into account the uncertainty concerning the return rate at the beginning of the planning horizon. All detailed proofs are presented in the Appendix 4. The optimal pricing decisions of the vertically integrated supply chain are as follows:

Proof: See Appendix 4.

5 Numerical analysis and comparison of the scenarios

To develop an illustrative comparison of the different scenarios possible, we conduct a numerical analysis in this section. For this purpose we set the following values for the parameters:

The expected value of \(\theta\) then equals \(E(\theta ) = \frac{\phi _1+\phi _2}{2} = 0.5\). Please recall that we normalized all input parameters to values between 0 and 1 and set the market potential to one, which is common in game-theoretic literature (Zheng et al. 2021; Debo et al. 2005; De Giovanni and Zaccour 2014; Vorasayan and Ryan 2006). Furthermore, we chose to set the parameters of the basic example in this way to ensure that both the production and remanufacturing processes are profitable and that both parties have an incentive to participate in the game. However, this need not always be the case, as will also be discussed in Sect. 5.4. Moreover, for the basic example \(c_c\) and \(c_t\) were set to be equal. This allows the analysis of the pure influence of the different levels of information on the players’ strategies without potential distortion due to a transfer payment. In Sect. 5.2 this assumption is relaxed and the influence of the transfer payment is examined in more detail.

The specific values of the parameters were estimated and based on values from practice in the field of consumer electronics. For example, it is indicated that 94%-98% of a returned laptop can be recycled (Lenovo 2023; Gemes 2023), which corresponds to the recycling efficiency \(\delta\). Having an expected value of 0.5 for product returns reflects the situation in Europe, where about 42% of e-waste is collected and recycled (Forti et al. 2020). Manufacturing costs were set eighty times higher than collection costs and transfer payments. In Germany, for example, the shipping of a laptop sent in by customers would cost €5.49, so the manufacturing costs are assumed to be €440 in relation. Lastly, we set the price sensitivity \(\beta\) to 0.9 in the upper range as consumer electronics are said to have a rather elastic demand (Holownia 2021; Timonen 2021).

5.1 Advantages and disadvantages of private information

The return rate is the key parameter in our model. In Scenario A, both players are involved in handling the returns and are therefore equally informed about the return rate after the first period. In Scenario B, instead, we consider a manufacturer-led collection mode and, hence, the return rate is a private parameter of the manufacturer. In both scenarios, the players have to anticipate \(\theta\) at the beginning of the planning horizon, i.e., when making their first-period decisions.

In Fig. 4, we show the players’ and the supply chain’s profits in the different scenarios and under variations of \(\theta\). For a comparison of the absolute values, Tables 2, 3, 4 also provide extracts from the numerical analysis. There, we also present the relative advantages of Scenario A over Scenario B in percent, both for the two players and for the entire supply chain, denoted by %, respectively.

From the numerical analysis we obtain some interesting and unexpected results:

-

Private knowledge of the manufacturer can be both beneficial and detrimental compared to the symmetric information case. At smaller return rates (\(\theta \le 0.5\)), Scenario A would be preferable, at higher return rates (\(\theta > 0.5\)), Scenario B is the better option.

-

For the retailer, on the other hand, Scenario B is surprisingly slightly better than Scenario A for almost all return rates, that is, when asymmetric information regarding returns is available. Only for very small return rates (\(\theta < 0.03\)) would it be better for it to participate in collecting returns.

-

At small return rates (\(\theta \le 0.4\)), the supply chains profit is higher in Scenario A than in Scenario B. In contrast, we observe that at high return rates (\(\theta > 0.4\)), the supply chain is better off under Scenario B than it is under A. The profit of the vertically integrated supply chain (Scenario C) (see Table 5) is always significantly higher than that of the other scenarios. This clearly shows the negative effect of double marginalization on supply chain profits.

To explain these effects, it is necessary to analyze the pricing mechanisms in more detail and to compare the profits in the different periods of time.

As can be seen from Table 3, the retailer’s first-period profit is always slightly higher in Scenario B than in Scenario A. Knowing that it will be confronted with asymmetric information in the future, the retailer determines the best possible strategy in the first period for all possible return rates, resulting in slightly higher margins in Scenario B (see also Fig. 5). This leads to the retailer compensating for possible later losses in period 2, which can occur due to the information asymmetries. As the retailer is unaware of the returns in the second period, it must set its price according to the calculated expected value, so that its margin is constant and independent of \(\theta\). With symmetric information, on the other hand, it is able to optimally determine its margin depending on the actual returns. In fact, the retailer is, therefore, worse off in Scenario B than in A in most cases comparing the second period profits only. Nevertheless, its strategy is successful and in terms of the total profit these losses can be compensated by the profits in the first period.

The manufacturer, on the other hand, may suffer from overestimations of returns (meaning \(\theta < E(\theta ) = 0.5\)) by the retailer in the second period as those result in lower wholesale prices in Scenario B than in Scenario A. In contrast, it benefits from underestimations (meaning \(\theta > E(\theta ) = 0.5\)), resulting in higher wholesale prices in Scenario B than in Scenario A (see Fig. 5). Hence, its profit is greater for small return rates in Scenario A, but for large return rates in Scenario B.

When analyzing the influence of market parameters, we find that advantages due to asymmetric information can arise as well. In principle, the market potentials \(\alpha _1\) and \(\alpha _2\) must each be sufficiently large so that a positive market demand exists and a feasible game arises. In terms of demand in period 1, Scenario A and B hardly differ. In both cases a positive market demand for \(\alpha _1 \ge 0.69\) is reached. In Scenario C, the VI case, we obtain a positive demand for \(\alpha _1 \ge 0.68\), see Fig. 6.

In terms of demand in period 2, it depends on the specific value of the return rate at which point a feasible solution is reached. We obtain a a positive demand \(q_2\) in Scenario A for \(\theta = 0\) for \(\alpha _2 \ge 0.72\), e.g., whereas it is the case for \(\alpha _2 \ge 0.75\) in Scenario B. The reason for this is once again that under Scenario B, higher prices are set due to the overestimation of returns by the retailer, which makes Scenario A preferable. At higher returns rates, the retailer underestimates returns in Scenario B, so that it sets prices too low. For \(\theta = 1\), e.g., we hence obtain feasible solutions for \(\alpha _2 \ge 0.68\) in Scenario A, in Scenario B slightly earlier for \(\alpha _2 \ge 0.65\), see Fig. 7.

However, the best results are again achieved in the VI case. For \(\theta = 0\) a value of \(\alpha _2 \ge 0.72\) is sufficient, as in Scenario A, but for \(\theta = 1\) a value of \(\alpha _2 \ge 0.63\) is necessary.

In general, once a feasible solution is reached, the players’ profits increase the larger the market potentials are, and they increase more the higher the return rate is. Nevertheless, since the values differ only slightly between the return rates, we show, as an example, the players’ profits for \(\theta = 1\) and under variation of \(\alpha _1\) for the different Scenarios in Fig. 8. It reveals again, that the VI scenario leads to the highest profits.

With respect to price sensitivity \(\beta\), we have similar observations. In general, all members of the supply chain benefit from low price sensitivity. If the retailer overestimates the returns in period 2, i.e. the returns are small, the retailer sets its price relatively too high and the players record higher profits in Scenario A. As \(\theta\) increases, Scenario B becomes more advantageous. However, the players can again achieve the highest profit in the VI case. The fundamental behavior of the players’ profits with variations in \(\beta\) can be traced in Fig. 9. Although we can observe differences within the various return rates, these are quite small, so we will illustrate the case of \(\theta = 1\) exemplary.

5.2 Channel preferences

If it is the case in practice that there is a choice between different collection options, players should opt for the variant that leads to the highest profit. The challenge for the players now is that the return rate is not yet known at the beginning of the planning horizon and, therefore, the profit is also subject to uncertainty. A risk-neutral decision maker should choose the variant with the highest expected profit value.

In Table 6, we compare the expected profits of the players in the different scenarios. The general symbolic expressions of the expected profits can be found in the Appendix 5 for each scenario.

As can be seen, both players have a higher expected profit in Scenario B than in Scenario A, so both players would favor Scenario B in our numerical example. For the retailer, the result is expected according to the previous analyses, since in most cases the retailer was observed to be slightly better off in Scenario B than in Scenario A. As was shown, it can compensate for disadvantages resulting from information differences over the two-period planning horizon. For the manufacturer, the result is surprising on the one hand, since it can have both advantages and disadvantages from asymmetric information. On the other hand, it shows that the advantages of private information outweigh the disadvantages when only the expected value is considered. However, depending on the actual returns, this channel preference could turn out to be disadvantageous for both players in retrospect.

Nevertheless, the profit that could be achieved through cooperation in the supply chain (Scenario C) is again much higher than in the other scenarios.

Interestingly, from expressions (A41) and (A42) in the Appendix 5, we can see that the transfer payment \(c_t\) has no effect on expected profits in Scenario A, and thus no effect on channel preference from the retailer’s perspective. No matter how the manufacturer would increase the transfer payment, Scenario B would always be more advantageous for the retailer in our example.

The reason for this can be traced in Figs. 10, 11, 12, 13. As can be seen in Fig. 10, the manufacturer’s profits increase the larger \(c_t\) and if the return rate is less than 0.5. Otherwise, profits decrease. For the retailer, the opposite phenomenon can be observed, see Fig. 11: profits increase for high return rates, but decrease for low return rates the higher the value of \(c_t\). At a return rate of 0.5, the payment \(c_t\) has no effect on the profit of either player. This result seems unintuitive at first, but it results from the uncertainties in the first period. To determine the optimal first period decisions, the expected profits are taken into account. The larger the transfer payment \(c_t\), the higher the manufacturer will choose its wholesale price to offset these costs, resulting in lower margins for the retailer in period 1 (see Fig. 13). In period 2, the return rate is then known to the players and the collection costs, being beyond influence and belonging to the past, have no further impact on current decisions. However, the larger the returns, the more costs can be saved in production, resulting in lower wholesale prices and higher retailer margins in period 2, independent of \(c_t\). Though, since the price in the first period was based on an estimate of returns, for return rates \(\theta > 0.5\) the retailer benefits from previous underestimations of the returns. In retrospect, the manufacturer has chosen its first period prices too low then. For the case \(\theta < 0.5\), however, the first period wholesale prices have been set too high, so that the retailer has disadvantages from an overestimation. If returns equal \(\theta = 0.5\), i.e. if expectations are equal to reality, the profits of the retailer and the manufacturer are always constant, i.e., independent of \(c_t\). Thus, \(c_t\) is always priced in by the manufacturer and therefore does not provide any direct financial benefit to the retailer. Additionally, as can be seen in Fig. 12, the profit of the entire supply chain is not affected by \(c_t\).

When calculating the player’s expected profits, however, the underestimates and overestimates offset each other, so that the expected values (Eqs. (A41) and (A42)) are actually independent of \(c_t\).

Interestingly, we also did not find any other parameter combination that would lead to Scenario A being more advantageous for one of the players than Scenario B, using the expected profits as the only decision criterion. However, due to the complexity of the expressions (Eqs. (A41)–(A44)), it cannot be excluded that such parameter combinations exist.

5.3 Profit division in the cooperation mode

The prices of the vertically integrated supply chain (see Eqs. (18) and (19)) lead to the maximum achievable profit in the supply chain. It must be noted, however, that cooperation can only take place if it puts both players in a better or equal position than without cooperation (Aust and Buscher 2012; Xie and Neyret 2009; SeyedEsfahani et al. 2011). Since in our paper the retailer is the Stackelberg leader and has the market power, in the absence of cooperation the scenario that maximizes the retailer’s expected profit would be present. We refer to this as the outside option. In order to induce the players to cooperate, they must receive at least the profit of this corresponding scenario, meaning

where

must hold. Therefore, also

must be valid, which is always the case, independently of i, due to the nature of vertical integration. Cooperation is thus always feasible in any case and there is always an extra profit \(\Delta \pi _{SC}\) which can be divided between the players.

However, due to the uncertainties that arise in the model, the following considerations must also be made:

-

The optimal VI price \(p_1^C\) in period 1 is independent of the return rate, since it is based on an estimated value. At the beginning of the planning horizon, however, the optimal price of the second period cannot yet be determined with certainty. Thus, if players consent to cooperate, at the time of contracting they must agree, with respect to the second-period price, on a general functional relation \(p_2^{C} (\theta )\) according to Eq. (19).

-

In period 2, the optimal VI price \(p_2^C\) can then be determined according to the number of returns. However, this requires that both players are equally informed about the return rate, meaning that the retailer should be involved in the collection process. Only then can it be ensured that the retailer does not receive false information about the returns, which could put the manufacturer in a better situation. With regard to profit sharing, the height of a transfer payment \(c_t\) is thereby irrelevant.

-

Players divide the additional profit from Eq. (23) according to their bargaining power and risk preference. It should be noted that Eq. (23) is based on the outside option and thus the expected values of the scenarios. Depending on the actual \(\theta\), it is possible that a different scenario would have led to higher profits in retrospect. Nevertheless, no player can be worse off under profit sharing than with the outside option.

-

There is an infinite number of possible combinations of prices and margins in both periods in order to achieve the desired profit division. Therefore, further elaborations will be omitted here and we only focus on profit sharing (Aust and Buscher 2012).

To determine how the additional profits should be divided between players, we adapt the bargaining model by Aust and Buscher (2012), who formulate the following optimization problem which maximizes the supply chain’s utility \(u_{SC}\)

where \(\lambda _M\) and \(\lambda _R\) are positive parameters reflecting the player’s risk attitudes concerning a possible termination of the negotiation game. \(\mu _M\) and \(\mu _R\) with \(\mu _M + \mu _R = 1\) reflect the bargaining power of the manufacturer and the retailer, respectively. The optimal results for this optimization problem are

For the proof, please see Aust and Buscher (2012).

In our numerical example it became obvious that without cooperation Scenario B would occur. In addition, let us now assume that the retailer, as the Stackelberg leader, has full bargaining power, i.e., \(\mu _R = 1\), and, hence, \(\mu _M =0\). This leads to the manufacturer getting exactly the profit of its outside option and the retailer retaining the entire additional profit for itself, regardless of the risk attitude of the players. In Table 7, the results are shown for different return rates \(\theta\). We first display the players’ profits of the outside option, i.e., Scenario B. The available extra profit \(\Delta \pi _{SC}\) is thereby calculated via Eq. (23) and added to the profit \(\pi _R^B\) to obtain \(\pi _R^C\).

5.4 Influence of uncertain and asymmetric information on CLSC activities

In this section, we examine the influences of uncertainty as well as the different collection modes on CLSC activities, i.e., the remanufacturing or recycling processes.

From the customer’s perspective, remanufacturing is advantageous if the manufacturer’s cost savings are reflected in pricing. As can be seen in Fig. 14, independently of the collection mode, customers should always have a vested interest in returning as many products as possible in the first period, as they can benefit from this at later points in time. The higher the return rate, the lower the second period prices in all scenarios. Surprisingly, however, remanufacturing does not always lead to smaller prices in the second period compared to the first period prices. Comparing the prices in Scenario C, the vertically integrated supply chain, it is observable that customers benefit from remanufacturing from a return rate of \(\theta \ge 0.5\) where the graphs in the figure intersect. Thus, it is only at medium or high return rates that customers have advantages from recycling. The reason for this is that although returns lead to falling costs and thus falling prices, these future returns are already anticipated in the pricing of the first period. Over- or underestimated returns then lead to higher or lower prices in period 1 compared to period 2.

In the case of a retailer-led collection mode (Scenario A), the price in period 2 is lower than in period 1 not till \(\theta \ge 0.70\). Regarding the manufacturer-led collection (Scenario B), this is already the case from a \(\theta \ge 0.61\). From this, we can conclude that, in the two-echelon supply chain, on the one hand, double-marginalization is disadvantageous for customers from a remanufacturing point of view which can be seen from the comparison with the vertically integrated supply chain. On the other hand, customers benefit from remanufacturing only at high return rates and, more likely, when players are not equally informed, i.e., only the manufacturer is responsible for the product collection. This is because the retailer chooses its price to be comparatively too low when returns are actually higher than it expected.

The extent to which product-remanufacturing activities are taking place is determined not only by the return rate but also by the absolute number of returns. As that number results from the return rate multiplied by the first-period demand, remanufacturing decisions in the second period are impacted by the number of products sold in the previous period. In the case of two planning periods, the sales quantity of the first period is, therefore, decisive.

From Fig. 14 we observe a slightly lower retail price \(p_1^B\) in Scenario B than \(p_1^A\) in A, whereas the retail price of the integrated supply chain \(p_1^C\) is significantly lower than in the other scenarios. This means that in the integrated case, demand is highest in the first period compared to the other scenarios, leading c.p. to the highest absolute returns. From a sustainability perspective, i.e., with regard to CLSC activities, the integrated supply chain is therefore again preferable.

The first-period sales volume is also influenced by the forecast of future returns. Figure 15 illustrates how the sales quantity in period 1, \(q_1^i\), is influenced by the lower and upper limits \(\phi _1\) and \(\phi _2\) of the interval of the uniform distribution. The higher \(\phi _1\) and \(\phi _2\) and, thus, the higher the expected value of \(\theta\), the larger the quantity sold in period 1. Higher expected returns and hence, higher expected future cost reductions, lead to a lower selling price in period 1, which stimulates demand. Thus, with identical true returns a higher expectation of returns alone leads to higher sales in period 1 and thus c.p. to larger absolute returns in period 2. Thereby, greater costs can be saved in production. Once again, the VI supply chain is clearly preferable among the scenarios, as customers pay the lowest prices here and demand is the greatest. Scenario A and B perform roughly equally, with Scenario B providing slightly higher values.

Figure 16 shows the second period sales volumes \(q_2^i\) in the different scenarios and under variations of \(\theta\). These sales volumes have no direct impact on CLSC activities in our case, but a hypothetic one on future remanufacturing, which would lie outside our considered planning horizon.

As we can see, neither collection mode can be clearly preferred in terms of future CLSC activities. If current returns are below the expected value (\(\theta < 0.5\)), the retailer sets its price comparatively too high, so demand is smaller in Scenario B than in A. If the current returns are above the expected value (\(\theta > 0.5\)), the manufacturer can reduce its costs more than expected, and the retailer has set its price comparatively too low. Customers benefit from this and demand increases. Again, we observe that customer’s demand is highest in the vertical integration case (Scenario C).

In Fig. 17 we see the comparison of the sales volumes in the second period \(q_2^i\) between the different scenarios and as a function of \(\phi _1\) and \(\phi _2\). The sales volume of the second period depends on the specific return rate. We find that, again, increasing estimation parameters \(\phi _1\) and \(\phi _2\) lead to higher sales volumes \(q_2^i\). An exception is Scenario B, where \(q_2^B\) decreases with higher estimation parameters. This is because as \(\phi _2\) increases, the expected value of the returns increases, making an overestimation more likely. In the case of a low expected value and an underestimation, on the other hand, the retailer sets prices too low, which increases the demand in comparison. However, it must be noted that \(q_2^B\) is larger than \(q_2^A\) in most cases due to misestimates of the retailer.

In summary, in terms of return quantities, neither collecting mode is clearly advantageous. Vertical integration, however, leads to the best results not only from an economic but also from an ecological point of view. This finding could be interesting in practice if, in addition to the pure profits of the players, subordinate objectives were relevant, such as recycling rates.

Apart from the sales volumes and pricing, whether integrating reverse flows into the supply chain is beneficial for the supply chain members depends on the relationship between the parameters \(\delta\), \(c_c\), \(c_t\), and \(c_m\). The absolute cost-savings compared to the collection costs are decisive. It is, therefore, not sufficient in our model to assume that remanufacturing is profitable for every \(c_c < c_m\). However, it is common in the current literature to assume a consistently positive effect of returns by assuming a fixed cost rate saved by remanufacturing (see, e.g., Savaskan et al. 2004; Savaskan and Van Wassenhove 2006; Zhang et al. 2014). Hence, our model provides a formulation that is closer to reality. High collection and reprocessing costs, e.g., naturally make recycling less attractive. Above a certain value \(c_c\), it would then be advantageous to completely refrain from accepting returns. It is interesting to note that these thresholds are influenced by the collection mode at hand and also differ with regard to the player under consideration. See Figs. 18, 19, 20, 21, 22, where we display the players’ profits in the different scenarios and under different values of \(\theta\) and \(c_c\). On the left side, three-dimensional figures are provided in each case. On the right side, we additionally show a cross-section through these figures as a two-dimensional illustration, which should facilitate the understanding of the following explanations. In the case of a retailer-led collection mode (Scenario A), small return rates become advantageous from a value of \(c_c = 0.71\) from the manufacturer’s point of view. From this point, we observe higher profits for smaller return rates in Fig. 18. From the retailer’s point of view, however, this is already the case from \(c_c = 0.07\), see Fig. 19. If there are no legal requirements to accept the returns anyway, the players should focus on forward flows in such cases. At the retailer, however, a second threshold is also visible in Fig. 19 at which the different graphs presented on the right side in the figure intersect, which is at \(c_c = 0.71\) as well, and from which high returns become advantageous again. It is not coincidental that these threshold values match at the retailer and the manufacturer. The higher the collection costs, the higher the margin set by the retailer in the first period which leads to losses in demand. Up to \(c_c = 0.71\), however, the retailer and also the manufacturer accept possible negative profits in period 1, which can be offset by profits in period 2 and still lead to a positive total profit. However, over the above-mentioned threshold, this approach is no longer helpful, and the demand in period 1 becomes formally smaller than 0. The subsequent solutions, therefore, lie outside the permissible range.

Under a manufacturer-led collection mode (Scenario B), remanufacturing is profitable up to \(c_c = 0.06\) from the perspective of the manufacturer, see Fig. 20. In contrast to that, the retailer would benefit from remanufacturing and the collection of returns up to \(c_c = 0.71\), see Fig. 21. We observe, therefore, the opposite behavior in comparison to Scenario A. The reason for this is that in Scenario A, the manufacturer passes the collection cost to the retailer if the transfer payment \(c_t\) is not increasing with higher collection costs as well. The retailer could therefore refuse to accept used products without a fair compensation payment. In Scenario B, on the other hand, the manufacturer must bear these costs itself, so that its thresholds are now similar to those of the retailer in Scenario A. Again, the demand of the first period is formally negative from a \(c_c =0.71\), so the subsequent solutions are not feasible. The reason for this, however, can be found in rising wholesale prices at the manufacturer’s side and resulting decreasing demand.

From this example, we can see how important it is to include future profits in the current decision-making process when considering a multi-period planning horizon. If the profits in period 2 were ignored, the players could refrain from CLSC activities earlier than necessary.

In direct comparison with the vertically integrated supply chain in Scenario C (Fig. 22), we see that here the first threshold value is at \(c_c = 0.13\), above which the collection of used products becomes disadvantageous. On the other hand, the threshold for negative first period demands and thus infeasible solutions is at \(c_c = 0.73\). Again, it becomes apparent that the vertically integrated supply chain has not only economic but also ecological advantages compared to the other scenarios.

With regard to the parameter \(\delta\), we observe similarly that remanufacturing is only profitable above certain threshold values. The remanufacturing process must be sufficiently efficient for the manufacturer to accept returns in practice. In Scenario A, this is the case for \(\delta \ge 0.36\), see Fig. 23. In the case of asymmetric information, the threshold is significantly lower at \(\delta \ge 0.18\), see Fig. 25. With a return rate of \(\theta =0\), the manufacturer would even experience decreasing profits for a larger \(\delta\) in this case. At a higher \(\delta\), the retailer expects greater cost savings in the manufacturer’s production process and increases its margin. The manufacturer must then reduce its wholesale price and, if it ultimately does not collect any returns at all, records losses. Interestingly, from the retailer’s perspective, there is also no threshold for \(\delta\) above which returns are profitable, see Figs. 24 and 26. Due to its pricing policy, remanufacturing is always advantageous for the retailer and it prefers high return rates, though it obtains slightly higher profits under asymmetric information. We include the comparison with the vertically integrated supply chain (Scenario C) in Fig. 27, where it becomes evident that remanufacturing becomes advantageous starting from a value of \(\delta \ge 0.09\), which again makes it the preferable scenario.

By contrast, the greater the manufacturer’s production costs, e.g., the greater the quantity of returns it prefers to receive. See Figs. 28 and 29, where the manufacturer’s profit is displayed for different values of \(c_m\) and \(\theta\). First, if the collection of items is more costly than cost-savings in production, remanufacturing is not a viable option. In Scenario A, remanufacturing is only meaningful from a value of \(c_m \ge 0.1\). In Scenario B, this is already the case from a value of \(c_m \ge 0.04\). These thresholds become apparent from the cross-section on the right hand side of the figures where the graphs of the different return rates intersect. Thus, it can be seen here as well that asymmetric information can be advantageous for the implementation of remanufacturing processes in some cases. The profit differences at different return rates are larger here than in Scenario A because the manufacturer suffers from the retailer’s misestimation of returns, especially at small return rates. The results for the retailer and the integrated supply chain are relatively similar here, thus we refrain from further illustrations.

6 Conclusion

In this paper, we presented a two-period game-theoretic model of a CLSC in which product returns are used by the manufacturer to reduce its production costs in period 2. It was assumed that the return rate is unknown to both players from the first-period perspective as it is a random parameter. Only at the beginning of period 2 do at least some of the players become certain about the exact return rate, depending on the collection mode under consideration. We examined three scenarios, namely the case of symmetric information under a retailer-led collection (Scenario A), the case of asymmetric information under a manufacturer-led collection (Scenario B) and a vertically integrated supply chain (Scenario C). Thus, in contrast to existing literature (see, e.g., Savaskan et al. 2004; Savaskan and Van Wassenhove 2006; Modak et al. 2018), we link the well-studied games with different collection modes to the players’ level of information.

With regard to the first research question, our analysis reveals that especially pricing in the second period is influenced by the collection mode at hand. If returns are overestimated, the second period price charged to the customers is higher in Scenario B than in Scenario A and lower otherwise. Due to double-marginalization in scenarios A and B, customers of the multi-stage supply chain generally pay more than in the vertically integrated case.

Related to this, we can answer our second research question. The numerical comparison of the two scenarios reveals that private information is not always associated with advantages for the informed player. If the retailer overestimates returns and, thereby, sets prices too high, this can be disadvantageous for the manufacturer. In other cases, the manufacturer can benefit from the retailer’s lack of information. On the other hand, we demonstrated that the retailer can compensate for disadvantages due to information deficits in the second period by its pricing policy in the first period in most cases. Surprisingly, the retailer is better off in Scenario B than in Scenario A, unless very small return rates occur. If the expected profit is used as a decision criterion for a scenario, both players are better off in Scenario B than in Scenario A in our study. We were able to prove that, interestingly, this decision is independent of the transfer payment between the manufacturer and the retailer. These finding thus can differ fundamentally from those in the literature on collection modes in CLSC under symmetric information. In the work of Savaskan et al. (2004), e.g., for example, the party closest to the customer has been found to be the most advantageous collector. Also De Giovanni and Zaccour (2014) find a manufacturer-led collection to be beneficial in many cases, although the choice of collection mode in their research under symmetric information has no influence on the second period strategies. Under asymmetric information, however, it does in our case, as the players determine their optimal decisions depending on their level of information. In the work of Modak et al. (2018), the level of the transfer payment is decisive for the advantageousness of the collection by the manufacturer or the retailer, which is irrelevant in our model. To overcome the inefficiencies of double marginalization and take advantage of the benefits of a vertically integrated supply chain we presented a simple profit sharing model in Sect. 5.3 that enables cooperation between the players.

With regard to our last research question, we observed that customers do not always benefit from recycling processes, depending on the return rate. Customers can only take advantage from price reductions in the case of large return rates and more likely, if asymmetric information are present. Other literature, however, may find that CLSC activities reduce second-period prices and thus stimulate consumption (Wang et al. 2018). In contrast, we further learned that, in the case of a small return rate, future CLSC activities are hindered by asymmetric information as sales volumes and, thus, absolute returns are smaller than in a symmetric information case. We also observed that the integration of remanufacturing processes does not always have to be advantageous for the players either. This is the case, for example, if the efficiency of the recycling process is poor or collection costs are too high. It was determined that it may be advantageous for the manufacturer itself to transfer the collection costs to the retailer. However, the retailer could refuse to accept used products without fair compensation payment, since above a certain threshold, collection can lead to economic disadvantages for it. It was further shown that the vertically integrated supply chain from Scenario C is superior to the other scenarios not only economically, but also with regard to remanufacturing or recycling, i.e., ecologically.

This leads us to the following managerial implications:

-

Since in practice the future returns are not known in advance, the expected value can be used as a decision criterion regarding a collection mode. If only a manufacturer-led and a retailer-led collection are available options, players should opt for collection by the manufacturer (Scenario B).

-

If possible, however, a contractual agreement between the players should be sought, as suggested in chapter 5.3. This way, the VI profit can be divided among the players without anyone being worse off than in Scenario B. Information asymmetries can thus be resolved.

-

Vertical integration should be pursued in practice not only from an economic point of view. There are also advantages in terms of CLSC activities and thus sustainability in the supply chain. Customers already benefit from lower return rates here and the volume of absolute returns itself is also the greatest.

-

The possibility of flexible pricing over multiple periods, as opposed to rigid planning with identical prices, enables decision-makers to offset information disadvantages throughout the planning horizon and should therefore be pursued.

-

Players should carefully check whether remanufacturing is generally reasonable in the selected game mode before the start of the game. As shown in Sect. 5.4, there are thresholds for the parameters \(\delta , c_c, c_t\), and \(c_m\) at which remanufacturing costs more than it saves in the production process. If there are no legal requirements to collect the products, players should refrain from doing so.

One avenue of future research could be to extend the two-period model to a multi-period one. Of course, this would increase the model complexity, but it might provide further interesting insights. It is conceivable that adding remanufacturing processes even further apart in time could have an impact on the profits of preceding periods. Examining other power structures in the CLSC could lead to further insights in our paper’s context as well. Furthermore, an interesting approach that could be reserved for future research is to investigate what influence strategic inventories might have on CLSCs under different collection modes and a multi-period setting. We conducted our numerical analysis not only with regard to economic metrics but also examined the influence of the players’ level of information on CLSC activities and sustainability. This approach could be further pursued in future research, considering a model with different objective functions for the players. Our model was also examined under the aspect that remanufactured and new products are indistinguishable and are therefore valued equally by customers. Although this is in line with the literature (see, e.g., Zhang et al. 2014; Wang et al. 2017; Mondal et al. 2020; Zhang et al. 2020; Wang et al. 2022), there is another path where a different product type is considered, and remanufactured products are attributed lower customer appreciation (see, e.g., Suvadarshini et al. 2023). This idea could also be applied to the model presented and compared to our paper.

References

Apple (2022). Trade In. https://www.apple.com/shop/trade-in. Accessed 11 Apr 2022